Real Estate Insights & Market Analysis

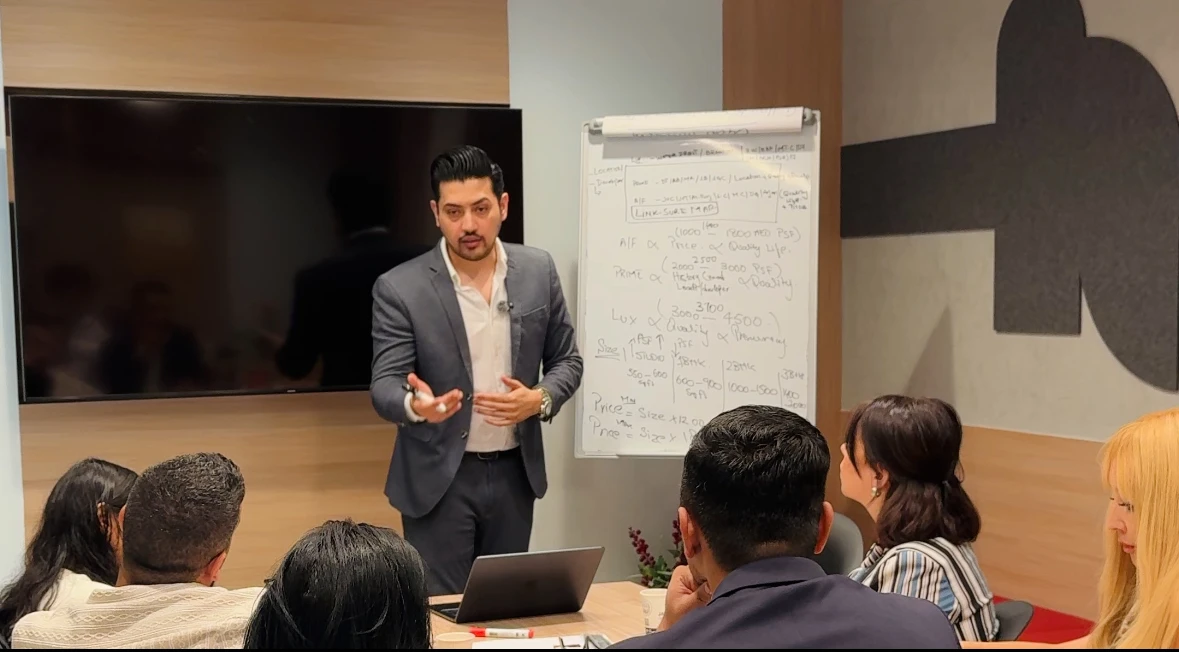

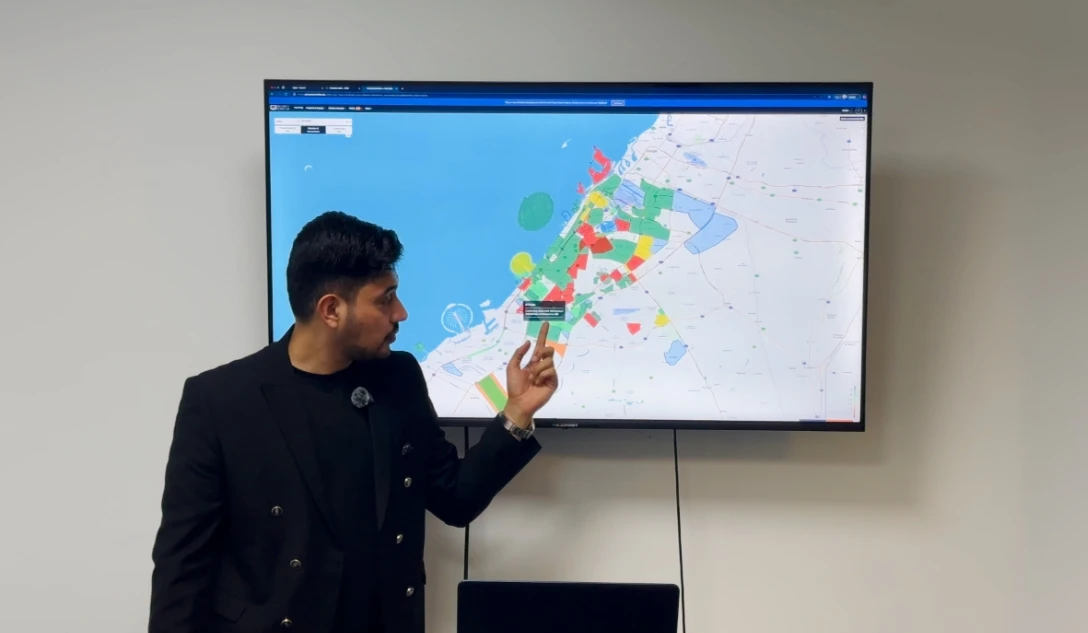

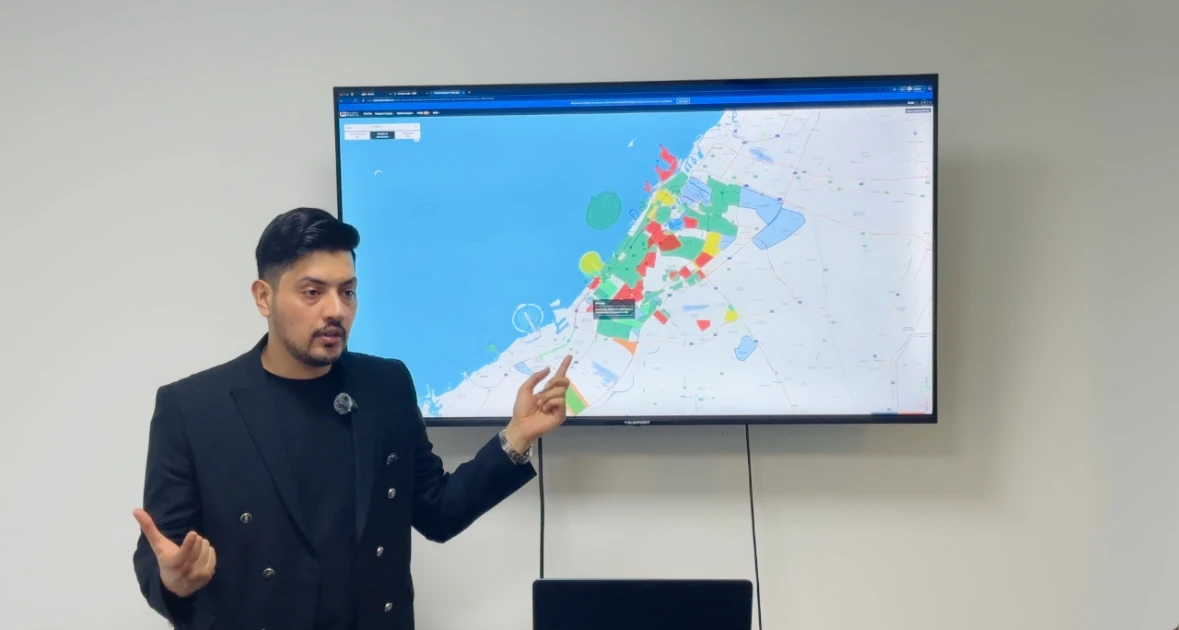

Expert insights, market trends, and investment tips from Ali Faizan - your trusted Dubai real estate consultant with 10+ years of experience and AED 500M+ in sales

AED in Sales

Happy Clients

Years Experience

Brokers Trained

Stay Updated with Market Insights

Get exclusive market reports, investment opportunities, and expert analysis delivered directly to your inbox every week.

If You Missed Dubai Hills in 2015, Read This: Why The Heights is Your Second Chance

We all have that one story: "I could have bought a Sidra villa for 3 Million." Today, that villa is 7 Million. The Heights in Dubai South is flashing the exact same signals Dubai Hills did a decade ago. Don't let history leave you behind again.

BREAKING: EOI Collection Officially Opens for The Heights Phase 2 (Serro & Salva)

The green light is on. Emaar has officially instructed brokers to start collecting Expressions of Interest (EOI) for the new Serro and Salva clusters. This is not a drill. If you want a unit, the paperwork needs to be submitted *today*.

The Dubai South "Super-Cycle": Why Emaar Waited for +24% Growth to Relaunch The Heights

Why sell for AED 900 PSF in 2023 when you can sell for AED 1,600 PSF in 2025? The data is out. Dubai South has appreciated by 24.41% in the last year alone. Here is why Emaar's "cancellation" was the smartest strategic move of the decade.

EOI Alert: The "Minimum Cheque" Strategy to Secure The Heights Phase 2 (Serro & Salva)

Emaar has raised the stakes. The EOI amounts for the new phases of The Heights are significantly higher than standard launches. Why? To filter serious investors. Here is the exact breakdown and my advanced strategy to ensure your cheque gets you a unit.

The Inventory Breakdown: 1,259 New Villas Hit the Market – Where Should You Place Your EOI?

1,259 units might sound like a lot, but in the context of an Emaar master community launch, it is a drop in the ocean. Here is the mathematical breakdown of supply versus demand, and my prediction on which units will vanish within 48 hours.

Salva vs. Serro vs. Serro 2: The Buyer’s Guide to The Heights Phase 1

Confused by the three different clusters launched at The Heights? You are not alone. In this guide, I break down the critical differences between Salva, Serro, and Serro 2 to help you decide where to place your capital.

The Lock and Leave Portfolio: Managing Second Home Collections from the UK with Ali Faizan Syed

Two-thirds of global HNWIs now prioritize second-home ownership in Dubai. Ali Faizan Syed provides the strategic execution for UK investors to build and manage "Lock and Leave" portfolios.

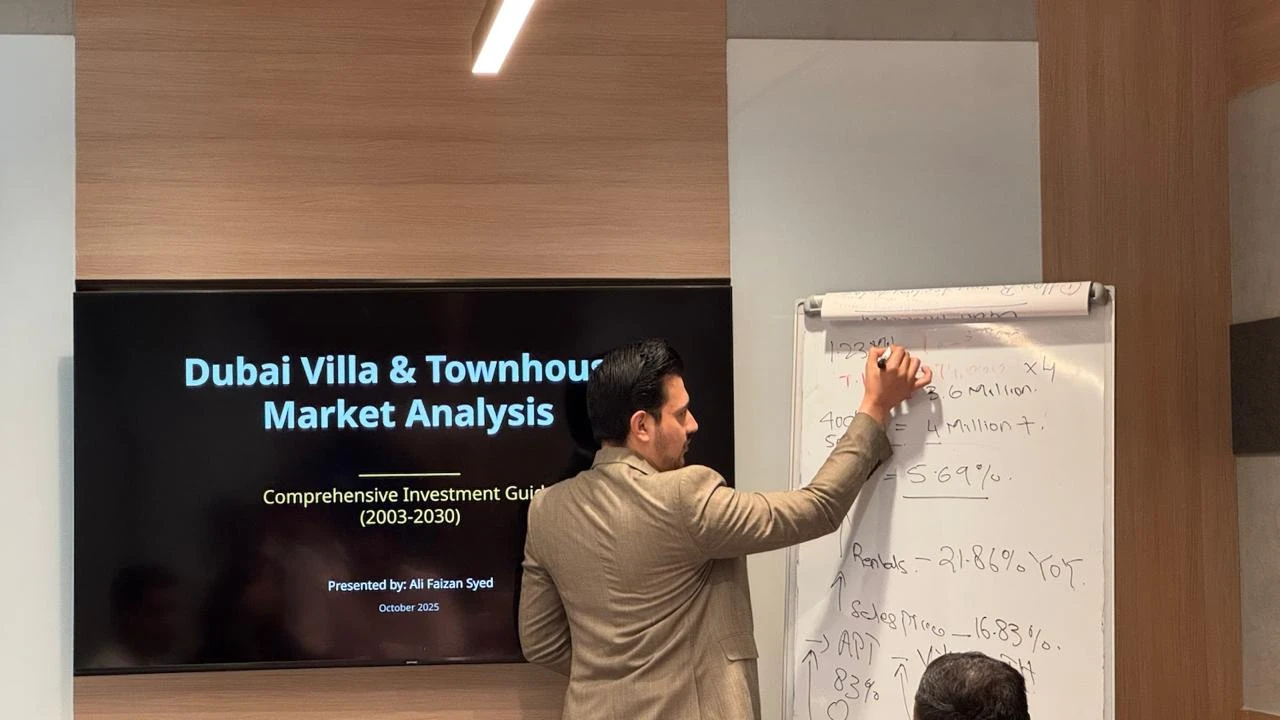

The Meydan City Velocity: Analyzing the 22 Percent Quarterly Rise in Apartment Values with Ali Faizan Syed

Meydan City has recorded a staggering 22 percent quarterly value rise. Ali Faizan Syed analyzes the infrastructure drivers and the 29 percent annual growth for UK investors.

The 80 Million Dollar Acquisition Strategy: Strategic Super-Prime Positioning for UHNWIs with Ali Faizan Syed

Public inventory for trophy assets is vanishing. Ali Faizan Syed provides the strategic roadmap for UK billionaires to execute US$ 80 million acquisitions in Dubai’s squeezed super-prime tier.

The Succession Briefing: Using DIFC Foundations to Protect UK Wealth Migration with Ali Faizan Syed

Protect your legacy from the 40 percent UK inheritance tax trap. Ali Faizan Syed provides the definitive roadmap for anchoring multi-generational wealth in Dubai using DIFC legal structures.

Land Ahoy: The Billionaire Strategy of Buying Bespoke Plots over Ready Units with Ali Faizan Syed

Developer standard luxury is no longer enough for the global elite. Ali Faizan Syed analyzes why 83 percent of HNWIs are pivoting to land plots to build bespoke legacies.

The 2040 Green Belt Audit: Buying Today Where the Parks Will Be Tomorrow with Ali Faizan Syed

In a desert city: green is the new gold. Ali Faizan Syed analyzes the 2040 Green Belt expansion and why buying near future parkland is the ultimate capital growth play.

The Cash Supremacy: Why 86 Percent of Transactions are Cash-Driven and What it Means for Liquidity with Ali Faizan Syed

Debt is the primary risk in global property. Ali Faizan Syed analyzes why Dubai’s 86 percent cash supremacy creates an unbreakable price floor for international capital.

The Scarcity Architecture: Why the 17.4 Percent Villa Segment is Fundamentals Proof with Ali Faizan Syed

In a market dominated by vertical supply, horizontal space is the ultimate luxury. Ali Faizan Syed analyzes why the 17.4 percent villa inventory is the safest vault for UK capital.

The 13.2 Million Sqft Office Shortage: Why Commercial Grade-A is the New Fixed Income Proxy with Ali Faizan Syed

Global office markets are cooling, but Dubai faces a Grade-A crisis. Ali Faizan Syed analyzes the 13.2 million sqft shortage and the 9 percent net yield opportunity.

The Renovation Multiplier: Achieving 450 Percent Uplift by Repositioning Old Bones in Emirates Hills with Ali Faizan Syed

Buying brand new is for the mass market. Repositioning mature assets is for the elite. Ali Faizan Syed analyzes the 450 percent uplift achieved on "Old Bones" in Emirates Hills.

Biological Equity: Why the Global Elite are Choosing Longevity-Driven Real Estate with Ali Faizan Syed

Wealth is no longer just measured in capital: it is measured in time. Ali Faizan Syed analyzes the rise of biological equity and the wellness-led real estate revolution in Dubai.

The Education Equity Link: Why a 6 Percent Spike in School Enrollments is Driving Villa Scarcity with Ali Faizan Syed

Families are the fastest growing segment of Dubai’s population. Ali Faizan Syed analyzes how a 6 percent spike in school enrollments is creating a permanent price floor for the villa market.

The Death of Speculation: Why a 4 Percent Flip Rate Proves Dubai is Now a Mature Global Fortress with Ali Faizan Syed

The "Bubble" narrative is dead. Ali Faizan Syed analyzes the structural shift from a 25% speculative market in 2008 to a stable 4% end user market in 2025.

The Regional Headquarters Ripple Effect: Navigating GCC Corporate Spillover in the Dubai Office Market with Ali Faizan Syed

The Saudi RHQ mandate is not a threat: it is a catalyst for the entire region. Ali Faizan Syed analyzes the corporate spillover driving Grade A scarcity in Dubai.

The Logistics Anchor: Why Industrial Job Growth is the Hidden Driver of the Dubai Office Market with Ali Faizan Syed

For every warehouse worker: there is a requirement for a desk. Ali Faizan Syed analyzes the 4% industrial job spike and why logistics hubs are the new office goldmine.

The Refurbishment Math: Converting Grade B Stock to Grade A Yields in the Dubai Office Market with Ali Faizan Syed

Grade A scarcity is driving an institutional gold rush into secondary stock. Ali Faizan Syed analyzes the AED 280 to 580 PSF refurbishment math that unlocks Grade A yields.

The Digital 2030 Play: Linking ICT Growth to Dubai Office Market Occupancy with Ali Faizan Syed

The digital transformation of the GCC is creating a new class of high-occupancy demand. Ali Faizan Syed analyzes the ICT sector boom and the scarcity of tech-ready floor plates.

The DIFC Scarcity Protocol: Strategic Asset Acquisition in Dubai’s Most Expensive Hub with Ali Faizan Syed

DIFC is slated for a 3.3 million sqft expansion. Ali Faizan Syed analyzes the 98% occupancy rate and why this high barrier hub is the ultimate vault for UK capital.

The Business Services Boom: Positioning Institutional Portfolios for the 41% Demand Segment in the Dubai Office Market with Ali Faizan Syed

Corporate migration is fueling the Dubai office market. Ali Faizan Syed analyzes the 41% demand surge from business services and how to position capital for high occupancy.

The Institutional Pivot: Why Major Developers are Shifting to Build-to-Hold in the Dubai Office Market with Ali Faizan Syed

Developers are no longer selling: they are holding. Ali Faizan Syed analyzes the 13.2 million sqft office expansion and why institutional owners are hoarding Grade A stock.

The ESG Paradox: Exploiting the 67% Shortage in Green Buildings within the Dubai Office Market with Ali Faizan Syed

Sustainability has moved from a moral choice to a financial mandate. Ali Faizan Syed analyzes the ESG supply gap and the 50% rental premium achievable in green offices.

The Capital Yield Spike: Why Institutional Wealth is Pivoting to Abu Dhabi Grade A Offices with Ali Faizan Syed

Abu Dhabi’s commercial sector has recorded a 28% annual surge in leasing rates. Ali Faizan Syed provides a technical audit of the capital’s Grade A scarcity and the 2027 pipeline.

The Fit-out Arbitrage: Strategic Capital Deployment in the Dubai Office Market with Ali Faizan Syed

Efficiency in the commercial sector is measured in "Turnkey Velocity." Ali Faizan Syed analyzes the fitted office premium and the fit-out arbitrage for institutional owners.

The Grade A Scarcity: Strategic Refurbishment and Yield Maximization in the Dubai Office Market with Ali Faizan Syed

The Dubai office market is facing a critical Grade A supply crunch. Ali Faizan Syed outlines the strategic pivot toward building refurbishment and yield stabilization.

The Succession Briefing: Using Dubai Real Estate to Anchor Multi-Generational Wealth with Ali Faizan Syed

The Great Wealth Transfer is here. Ali Faizan Syed provides the strategic roadmap for UK Family Offices to use Dubai real estate as a multi-generational wealth anchor.

The Institutionalization of Private Rent: Why UK Family Offices are Dominating Dubai’s Build-to-Rent (BtR) Market with Ali Faizan Syed

London’s rental market is trapped in a regulatory squeeze. Ali Faizan Syed provides the strategic roadmap for UK Family Offices to dominate Dubai’s high-yield Build-to-Rent (BtR) sector.

Superyacht Berthing and Private Jets: The Infrastructure Logistics of Billionaire Wealth with Ali Faizan Syed

For the global billionaire: a property is only as valuable as its mobility. Ali Faizan Syed explains why UK UHNWIs are anchoring wealth in Dubai’s infrastructure-led hubs.

The ESG Alpha: Why UK Billionaires are Pivoting to Vintage Carbon and Green Real Estate with Ali Faizan Syed

Sustainability is no longer a moral choice: it is a financial mandate. Ali Faizan Syed provides the strategic roadmap for UK billionaires to align portfolios with the new ESG Alpha.

The Grade A Commercial Crisis: Why UK Family Offices are Securing Dubai Office Footprints with Ali Faizan Syed

While the world faces office obsolescence, Dubai faces an office crisis: 95% occupancy. Ali Faizan Syed outlines the commercial pivot for UK Family Offices.

The Super Prime Squeeze: Analyzing the 65% Contraction in Dubai’s Luxury Inventory with Ali Faizan Syed

Global UHNWIs are absorbing trophy assets faster than they can be built. Ali Faizan Syed diagnoses the 65% inventory contraction and why British wealth must move now.

The Branded Residence Alpha: Why UK Billionaires Pay a 115% Premium for Strategic Real Estate with Ali Faizan Syed

Branded residences in Dubai trade at a 115% premium. Ali Faizan Syed explains why the global elite are pivoting to fashion and automotive-led properties for long-term wealth preservation.

The Great Wealth Transfer: Why UK Family Offices are Re-Domiciling to DIFC and ADGM with Ali Faizan Syed

US$ 84 Trillion is shifting between generations. Ali Faizan Syed provides the definitive briefing for UK Family Offices migrating to the legal fortresses of the DIFC and ADGM.

The Family Fortress: Why British Parents are Moving Family Legacies to Dubai with Ali Faizan Syed

For the British parent: the safety of their children and the sanctity of their inheritance are under threat. Ali Faizan Syed provides the strategic roadmap to a Dubai family fortress.

The Commercial Pivot: Why Savvy UK Capital is Anchoring in Dubai’s Hybrid Hubs with Ali Faizan Syed

London’s office and commercial sectors are navigating a phase of obsolescence. Ali Faizan Syed provide the strategic roadmap for UK investors to anchor in Dubai’s high-occupancy hybrid hubs.

The Exit Velocity: Re-Baselining UK Portfolios into Dubai’s High-Velocity Growth with Ali Faizan Syed

Managing a legacy of decline in the UK is a full time burden. Ali Faizan Syed provides the strategic roadmap for British investors to achieve "Exit Velocity" in Dubai.

From Accidental to Strategic Millionaires: Re-Engineering UK Property Wealth in Dubai with Ali Faizan Syed

The UK is full of "Accidental Millionaires" trapped by tax. Ali Faizan Syed provides the strategic roadmap for British investors to unlock their equity and multiply it in Dubai.

The Prime Migration: An Analytical Deep Dive into UK vs. Dubai Real Estate Returns with Ali Faizan Syed

British wealth is facing a structural squeeze. Senior consultant Ali Faizan Syed provides a detailed analytical comparison of the UK and Dubai markets using 2025 global wealth data.

Portfolio Architecture: Scaling from a Single Unit to a Managed Villa Collection in 36 Months with Ali Faizan Syed

Moving from a single asset to a global legacy requires more than luck: it requires architecture. Ali Faizan Syed outlines the 36-month strategy for UK wealth compounding.

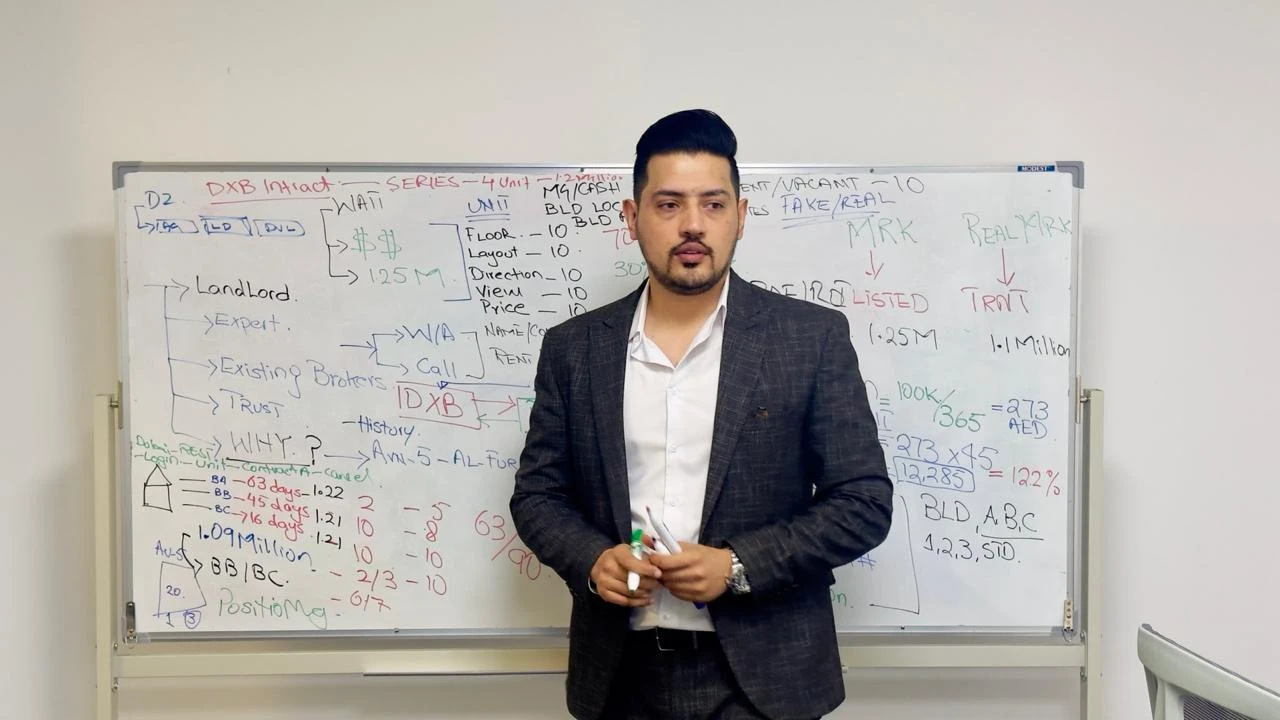

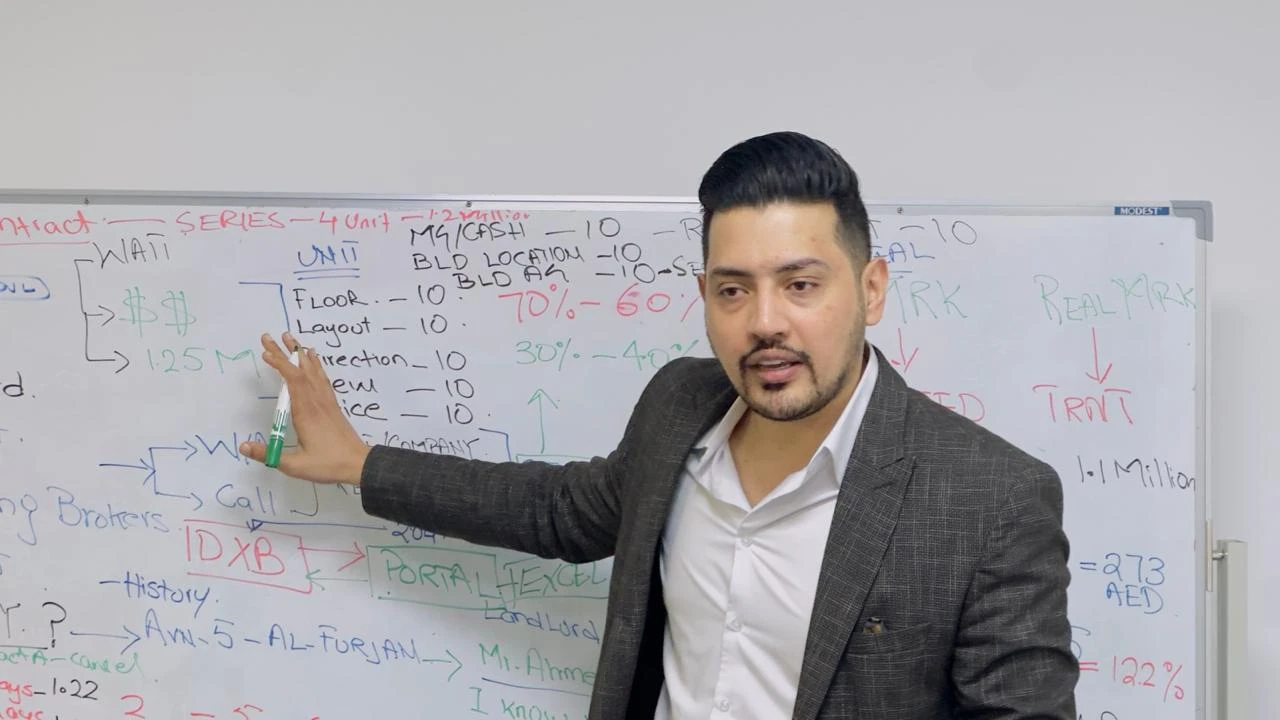

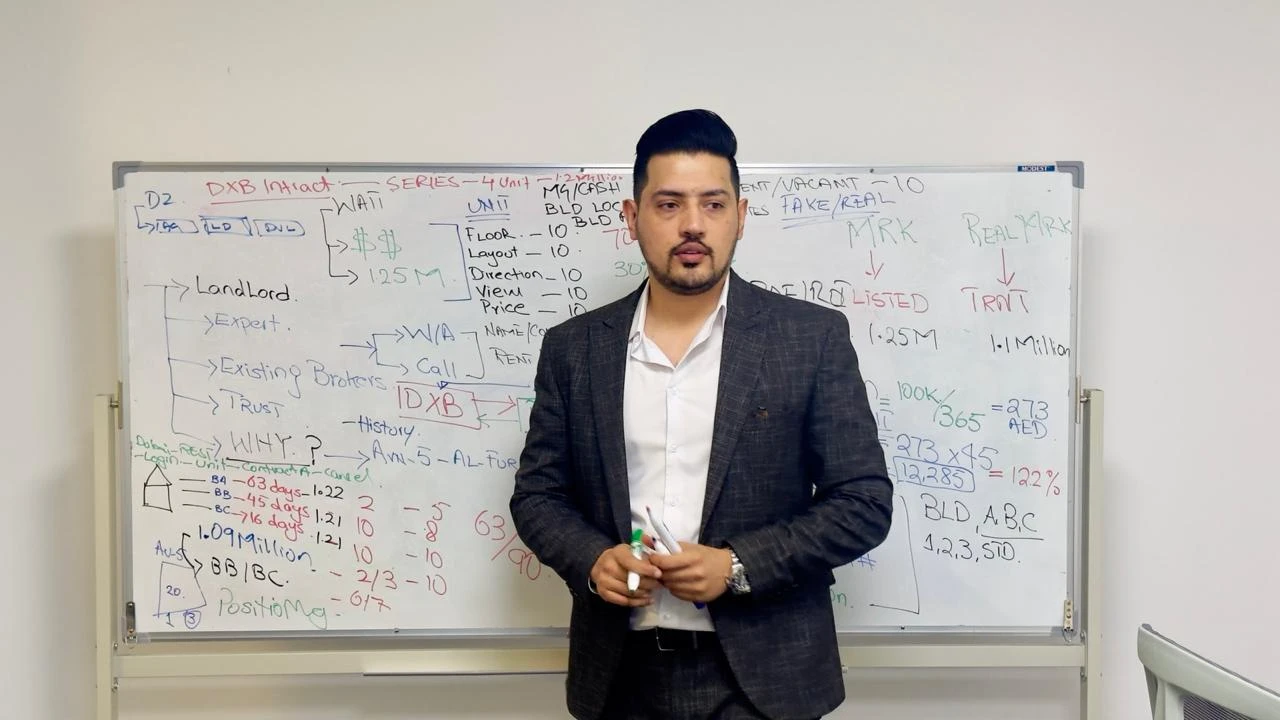

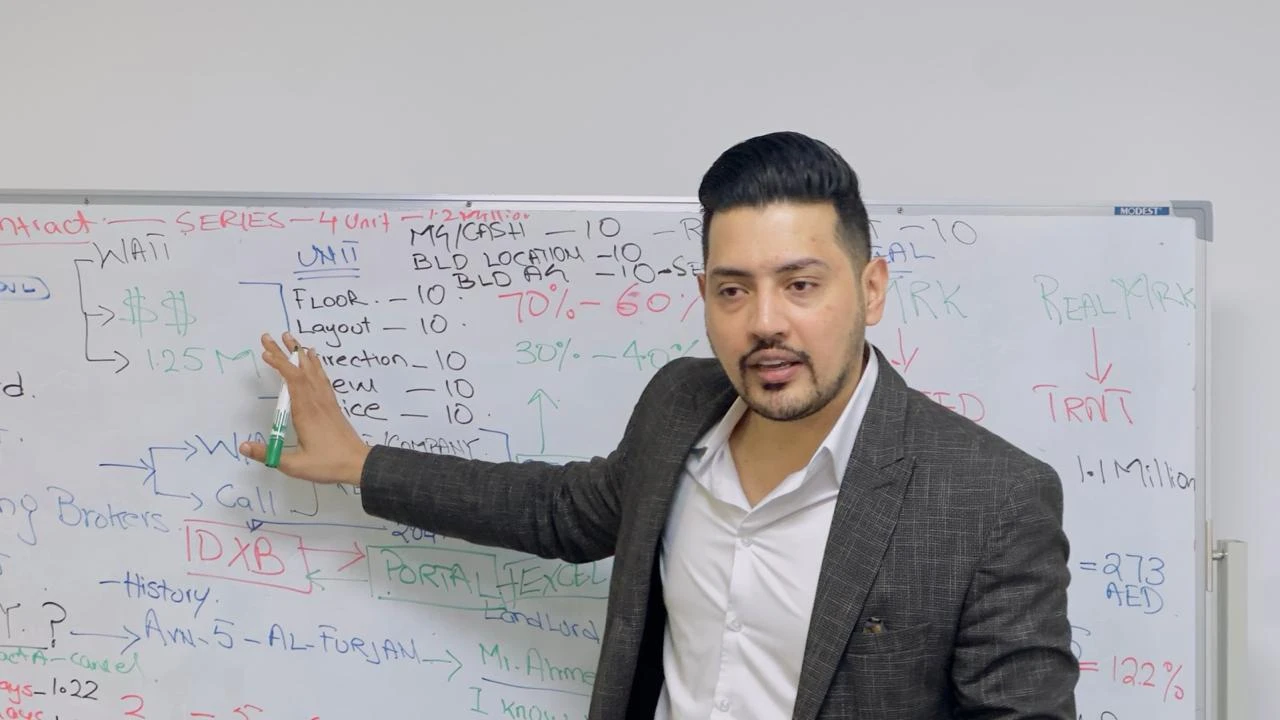

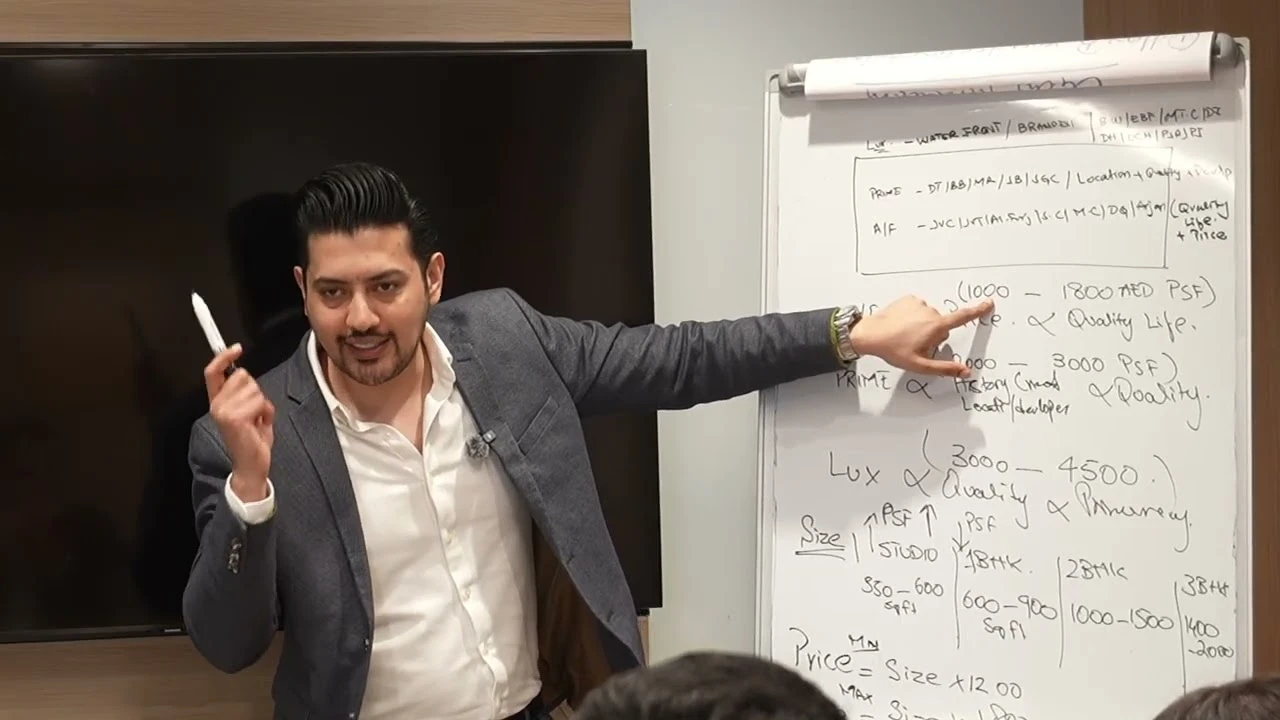

The Consultant vs. The Broker: Why 90% of Dubai Agents are Wasting Your UK Capital with Ali Faizan Syed

The Dubai market is flooded with 90,000 brokers. Ali Faizan Syed explains why high net worth UK investors need a strategic consultant to navigate the noise and secure real equity.

The Golden Visa Prescription: Replacing the UK Non-Dom Status with a 10-Year Dubai Legacy with Ali Faizan Syed

As the UK dismantles the non-domiciled tax regime: Ali Faizan Syed provides the strategic bridge for British entrepreneurs to secure a tax-free: 10-year legacy in Dubai.

The Frictionless Move: Navigating Global Fund Transfers and Legal Wealth Migration with Ali Faizan Syed

Moving capital across borders is the primary barrier for UK investors. Ali Faizan Syed provides a frictionless, legal, and low-fee roadmap for wealth migration to Dubai.

The Cost of Hesitation: Why Waiting 30 Days Costs UK Investors 0.88% in Capital Gains with Ali Faizan Syed

Hesitation is the most expensive luxury in a high velocity market. Ali Faizan Syed uses latest global analytics to show why UK investors lose 0.88% in equity every month they wait.

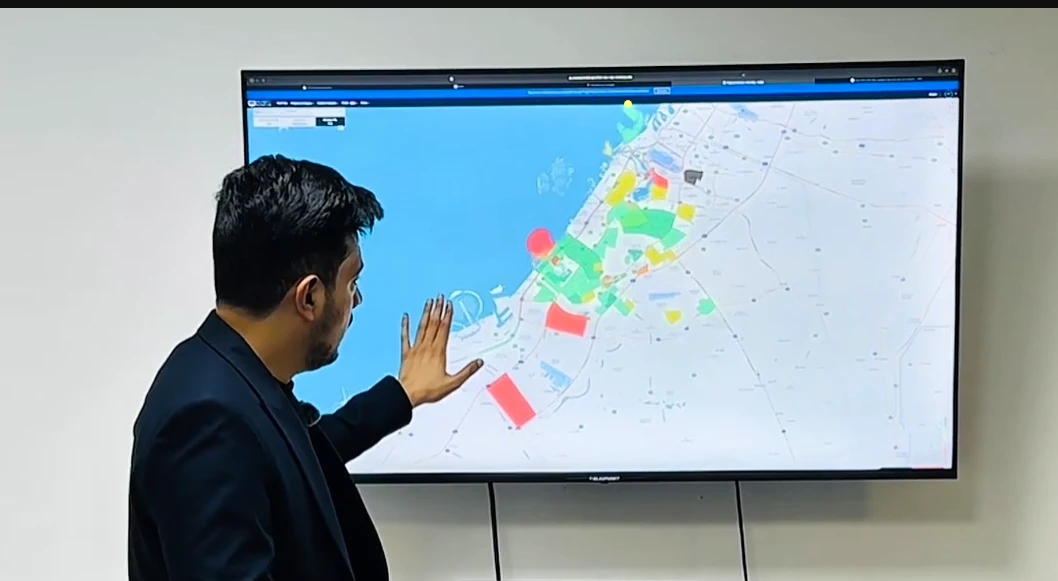

Waterfront Scarcity and the 7% Rule: Why UK Capital is Flowing to Dubai’s Coastline with Ali Faizan Syed

Only 7% of Dubai’s land is waterfront. Ali Faizan Syed analyzes why this extreme scarcity creates a "Capital Alpha" for UK investors that London cannot replicate.

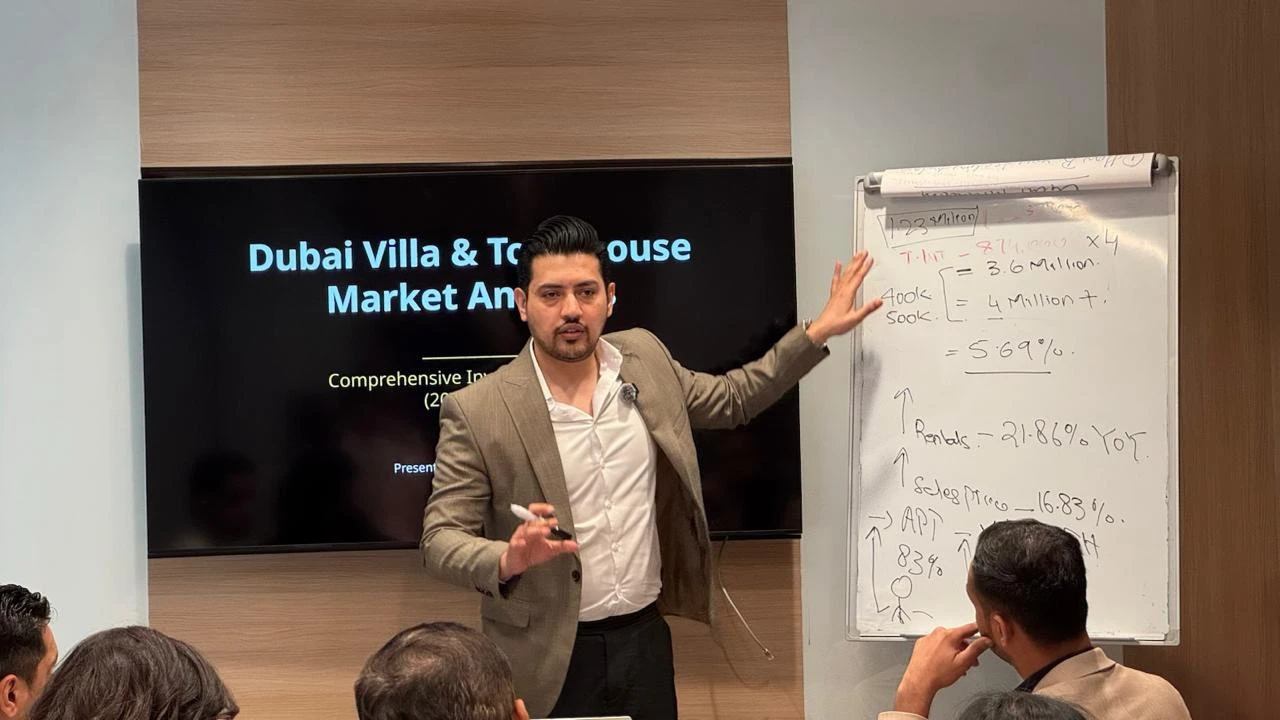

The Villa Inventory Gap: Strategic Family Wealth Positioning with Ali Faizan Syed

Dubai's villa market is a game of scarcity. Ali Faizan Syed analyzes why the 17.4% inventory bracket is the ultimate safe haven for UK families and their global capital.

The Sterling Hedge: Protecting Your Wealth from Pound Depreciation with Ali Faizan Syed

The British Pound has lost 25% of its global dignity. Ali Faizan Syed provides the strategic roadmap for UK investors to hedge their wealth using the USD-pegged Dubai property market.

The 2025 ROI Audit: Comparing London Net Yields vs. Dubai with Ali Faizan Syed

London net yields are under pressure from tax and interest. Ali Faizan Syed provides a numerical audit of Dubai’s 7.4% average yield and the ROE model for UK investors.

The Capital Gains Escape: Strategic Wealth Migration with Ali Faizan Syed

British wealth is under pressure from structural restrictions. Ali Faizan Syed provides the strategic roadmap to migrate capital to Dubai’s 0% tax environment.

The Sterling Hedge and The 10 Year Legacy: Why UK Entrepreneurs are Re Baselining in Dubai with Ali Faizan Syed

Protect your capital from the declining dignity of the Pound. Ali Faizan Syed provides a strategic roadmap for UK entrepreneurs to transition wealth into the high growth, tax free Dubai market.

Wealth Preservation Strategies: Why UK Investors are Shifting Capital to Dubai with Ali Faizan Syed

British wealth is under pressure from rising taxes and a cooling London market. Ali Faizan Syed provides the strategic bridge for UK investors to migrate to Dubai’s high growth environment.

The Great British Wealth Migration: Why UK Investors are Choosing Ali Faizan Syed for Dubai Real Estate in 2025

Discover why British investors are fleeing the UK tax squeeze. Ali Faizan Syed provides a data backed comparison of the London and Dubai markets for 2025.

Wealth Migration Guide: Why UK Investors are Shifting Portfolios to Dubai Real Estate with Ali Faizan Syed

Experience a deep analytical and emotional dive into why Ali Faizan Syed is the bridge for UK investors moving from the high tax London market to Dubai’s high growth environment.

The 7% Scarcity Rule: The Secret to Waterfront Wealth

In a desert city, water is gold. Only 7% of Dubai's total inventory is waterfront. If you aren't investing in scarcity, you're just buying concrete. Let's look at the data.

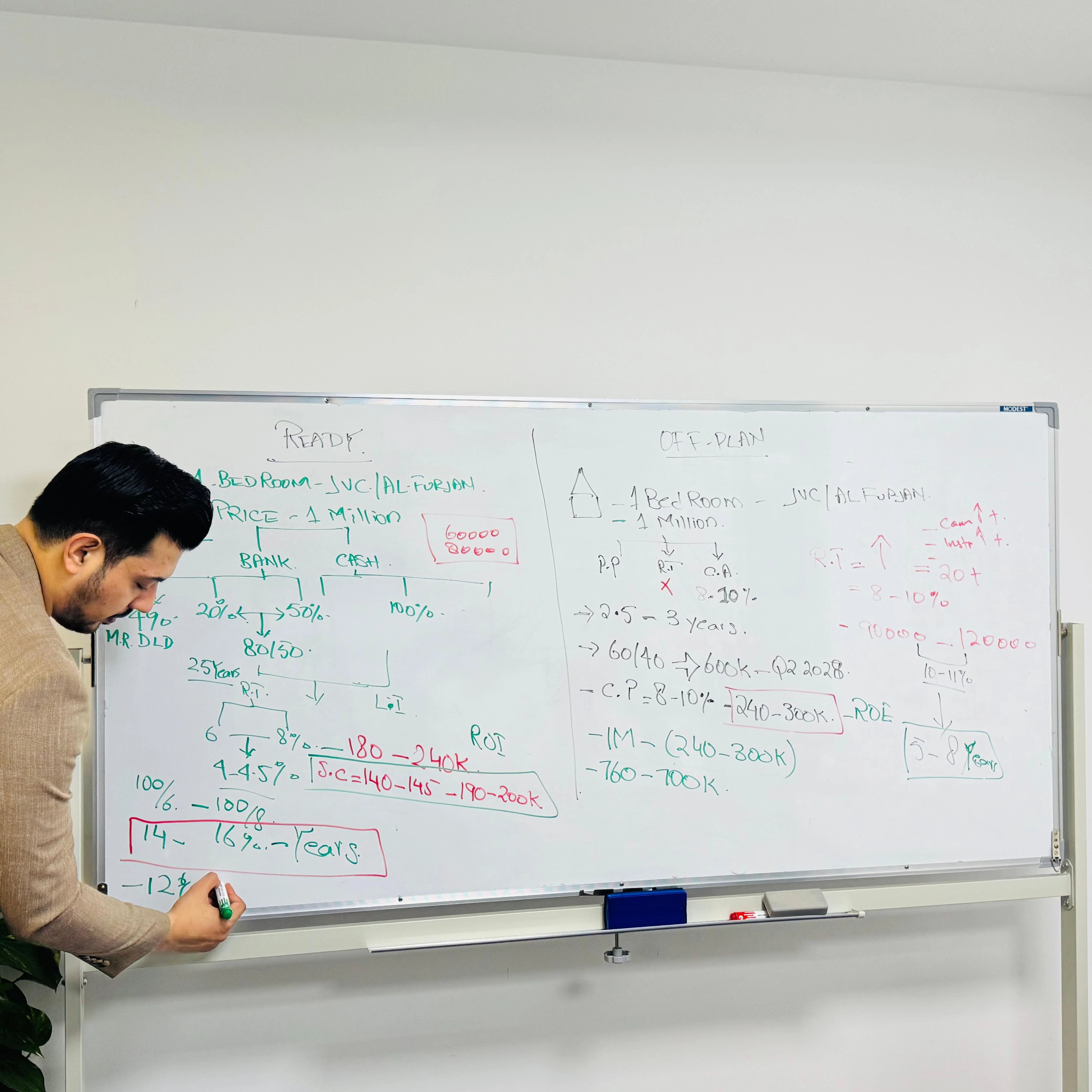

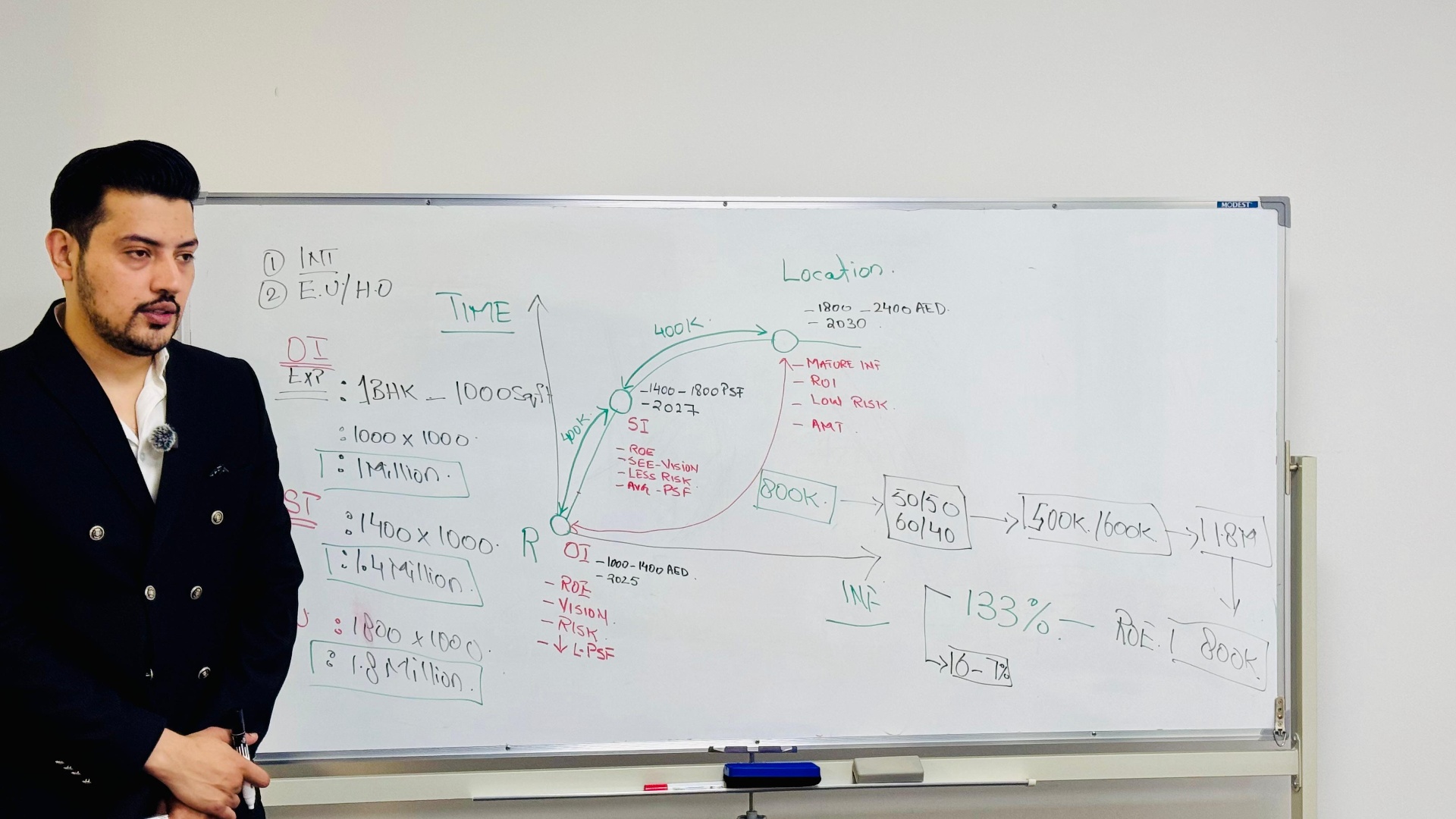

The ROI Trap: Why Strategic Investors Focus on ROE in Dubai

Most brokers talk about ROI to sound smart. I talk about ROE to make you wealthy. Discover the surgical math of leverage and why your cash-on-cash return is the only number that matters.

Don't be fooled by 7% rental yields. Professional investors use leverage to achieve 100% Return on Equity (ROE). Learn the surgical math of the 50/50 plan.

The 7% Rule: Why Waterfront Property is the Last Safe Haven

In a desert city, water is gold. Only 7% of Dubai’s inventory is waterfront, and less than 3% has direct beach access. Discover the power of scarcity.

Why I am the Second Doctor of Real Estate: The Diagnosis Your Portfolio Needs

Most of the 90,000 brokers in Dubai are "pill givers" offering quick fixes. I am the "Second Doctor" who performs a surgical diagnosis of your holding power and financial health.

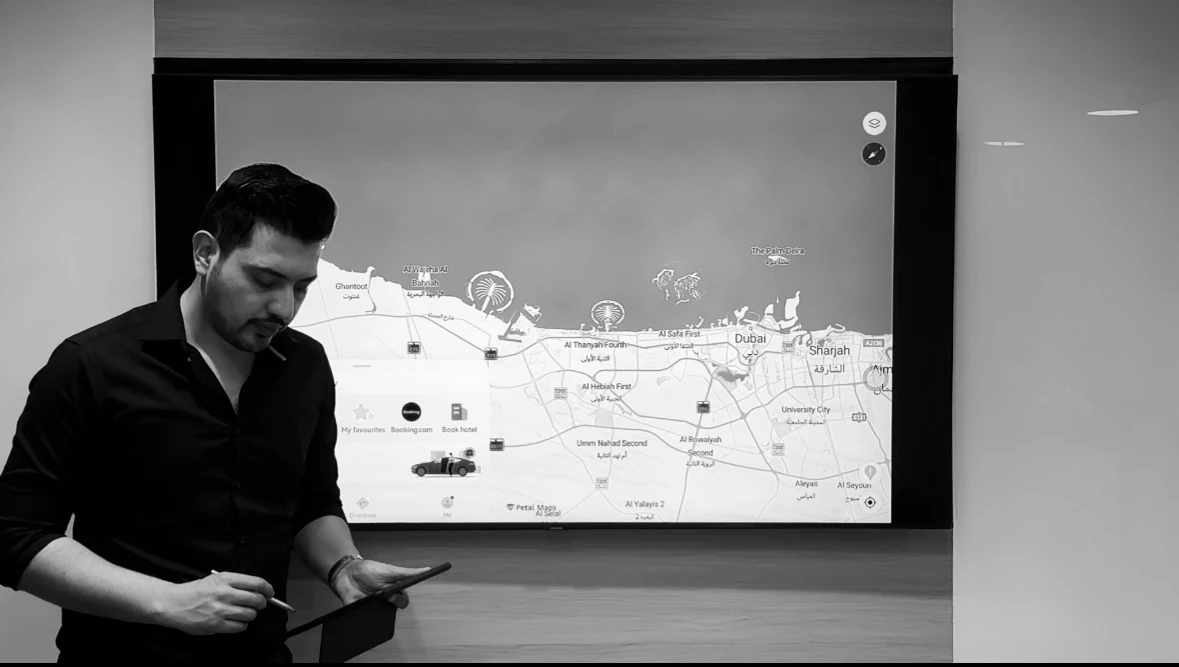

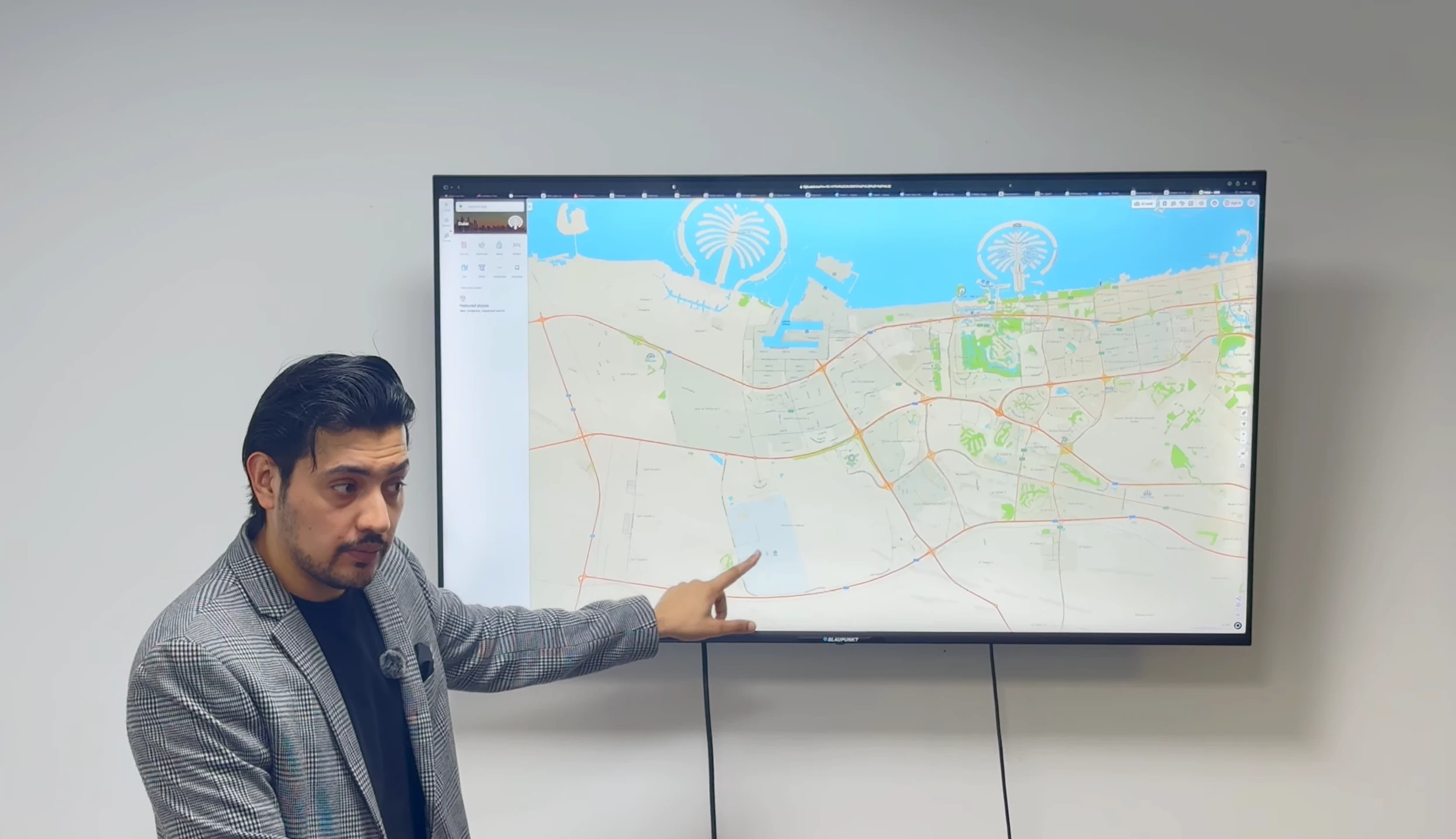

The 1 Million Resident Vision: Why Dubai South is the Last Frontier of Wealth

While average brokers chase commissions in saturated hubs, elite investors look at the 2033 agenda. Dubai South is a city built as a company, and the 1,100 AED PSF window is closing fast.

Psychological Profiling: Which of the 4 Investor Brain Types Are You?

Most brokers treat every client the same. I treat your brain. Discover why "Logicians" make the most money while "Socializers" stay stuck in the friendship zone.

The JVC Reality Check: Navigating the 65,000 Unit Influx

JVC is high volume and high risk. While brokers scream "buy," I say "diagnose." Learn why the specific unit series you choose determines whether you profit or perish in 2028.

Opportunity vs. Security: Which Phase of the Market Are You In?

Do you buy the desert or the lifestyle? Discover which category you fit into and how the timing of your entry determines your ultimate profit.

Currency Protection: How the AED-USD Peg Safeguards Your Global Wealth

If you keep your money in a depreciating currency, you are losing wealth every day. Discover how the Dubai Dirham acts as a stable global vault for your capital.

Al Jadaf: The Underrated Center of Old and New Dubai

Al Jadaf is the bridge between the heritage of Old Dubai and the innovation of the New. Discover why this underrated hub is the next big growth story.

The 03 Series Secret: Why Floorplan Analysis Beats Marketing Brochures

Brochures sell the building. I sell the unit. Discover why the specific series you choose is the difference between a high profit and a stagnant asset.

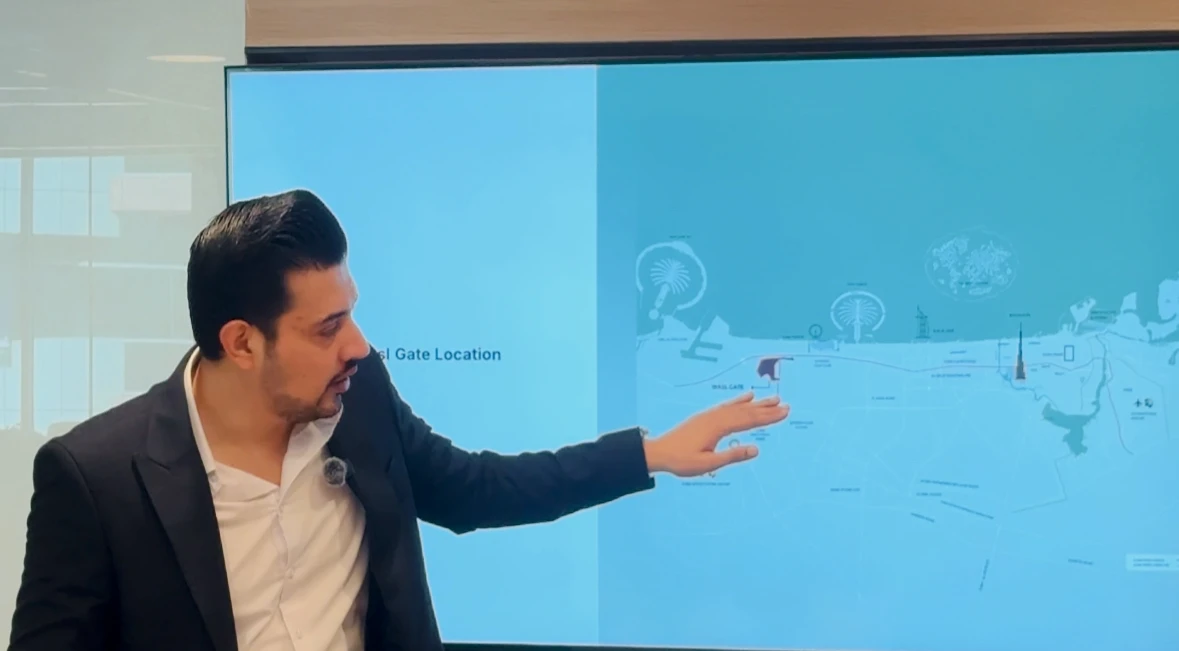

The Al Maktoum Effect: Investing in the Future of Global Aviation

The rulers of Dubai run this city like a CEO runs a multi billion dollar company. Discover why the world's largest airport is the engine of your future wealth.

The Business Bay Equilibrium: Why Commercial Density Drives Residential ROI

In Business Bay, traffic isn't a problem: it is a sign of high demand. Discover why this community’s unique balance makes it a bulletproof rental play.

The Currency Vault: AED Stability and the Mathematical End of Global Depreciation

If you keep your money in a depreciating currency, you are losing wealth every day. Discover how the Dubai Dirham acts as a stable global vault for your capital.

Your money doesn't go to the developer: it goes into a fortress. Discover how the Escrow system ensures that your investment is delivered or refunded.

The 17.4 Percent Fortress: Why Villas Survive Market Corrections

Apartments make up 83% of the market. Villas make up only 17.4%. If you want to avoid competition at handover, you need to own the limited supply.

Brain Types and Bank Accounts: The Psychology of the 57 Million AED Deal

Most brokers treat every client the same. I treat your brain. Discover why "Logicians" make the most money while "Socializers" stay stuck in the friendship zone.

The CEO of Cities: How Dubai’s Corporate Neutrality Protects Your Global Capital

The rulers of Dubai do not just rule: they operate this city as a CEO runs a global corporation. Discover why this mindset makes Dubai the safest vault for your wealth.

Billionaire Row Arbitrage: Why Maritime City is the Successor to Palm Jumeirah

In a desert city, water is gold. Only 7% of Dubai's total inventory is waterfront. If you aren't investing in scarcity, you're just buying concrete. Let's look at the data.

The 03 Series Blueprint: Floorplan Secrets That AI Will Never Understand

AI can fetch data, but it cannot select the unit that builds your legacy. Discover the gap between digital information and surgical real estate knowledge.

The 14 Year Trap: Why Ready Property is a Stagnant Asset for Wealth Builders

Most brokers sell ready units because they are easy to explain. I avoid them because they are a liability for aggressive growth. Discover the math of the 14 year trap.

JVC 2030: Navigating the 65,000 Unit Supply Deadline

JVC is high volume and high risk. While brokers scream "buy," I say "diagnose." Learn why the Nakheel deadline means you must act with surgical precision.

Human Knowledge vs AI Information: Why Your Dubai Investment Needs a Surgeon

Information is free but knowledge is rare. In a market saturated with 90,000 brokers doing donkey work, only a data certified surgeon can protect your capital.

Professional Integrity: Why I Refuse Kickbacks and Block Clients

I am not ready to sell my professional respect for money. Discover why I block clients who ask for "kickbacks" and why my "No" is more valuable than any broker's "Yes."

Maidan Horizon vs Business Bay: The Battle of the 2km Lagoon

Business Bay has the density, but Maidan Horizon has the swimmable lagoon. Discover why this 100 plot community is the next big play for Opportunity Investors.

The Cuddle and Slap Technique: Why Market Urgency is Pure Logic

Brokers use hype to build urgency. I use data. Discover the "Cuddle and Slap" technique and why every month of indecision costs you 0.88% of your capital.

The Psychology of the 57.8 Million AED Deal: Decoding the 4 Buyer Brains

Closing a 57.8 million AED deal isn't about luck: it is about behavioral psychology. Discover which of the four quadrants your brain occupies and how it dictates your wealth.

The Currency Vault: Why the AED-USD Peg is Your Global Wealth Hedge

If you keep your money in a depreciating currency, you are losing wealth every day. Discover how the Dubai Dirham acts as a stable global vault for your capital.

The Second Doctor’s Protocol: Why I Perform a Financial CT Scan on Every Client

Brokers are pill givers. I am the surgeon. Discover why a financial CT scan is required before you sign any property contract in the Dubai market.

Billionaire Row Arbitrage: Why Maritime City is the Successor to Palm Jumeirah

Water is gold in a desert city. With only 7% waterfront inventory, Maritime City represents the last remaining arbitrage play for the savvy investor.

The 17.4 Percent Scarcity: Why Villas are the Ultimate Defensive Wealth Asset

Apartments are a commodity, but villas are a trophy. Discover why the 17.4% scarcity of villas makes them the safest haven for strategic capital in Dubai.

The AI Mirage: Why ChatGPT Will Cost You Millions in the Dubai Market

In a market with 90,000 brokers doing donkey work, AI is just another tool for information. I provide the surgical knowledge required to build a legacy.

A 7% rental yield is a trap that takes 14 years to recover. Discover how to reduce your wealth cycle to 5 years by shifting from ROI to ROE.

The CEO City: Why Global Neutrality and the D33 Agenda are Your Greatest Wealth Guards

Dubai isn't just a city: it's a global corporation. Discover how the CEO mindset of the rulers ensures 0.88% monthly growth and total capital safety.

The 90,000 Home Deficit: Why Over-Supply is a Mathematical Illusion

Brokers scream about "over supply" to scare you, but the numbers tell a different story. Dubai needs 90,000 homes a year but only delivers half. Discover the real math.

The 99 Year Myth: Understanding Building Life Cycles and the Freehold Advantage

Buildings don't die: they get refurbished. Discover why the "25 year age limit" is a myth and how the 99 year freehold rule protects your family's future.

The Double Bite Technique: Capturing Waterfront Arbitrage in Maritime City

In a desert city, water is gold, yet only 7% of Dubai is waterfront. Learn how the Double Bite technique turns industrial warehouses into ultra luxury wealth hubs.

The 250,000 Job Engine: Why Dubai South is a Corporate Expansion Plan, Not a Residential Project

Dubai South is targeting 1 million residents by 2033. Discover why the Al Maktoum Airport expansion is a job-creation machine that makes 1,100 AED PSF the ultimate entry point.

The Price of Hesitation: Why Delaying Your Dubai Real Estate Investment Costs You 0.88% Every Month

In a market where developers sell out in two hours, hesitation is the biggest expense. Drawing on precise Q1 2025 data, I break down the cost of waiting an increase of 0.88% per month and why using logic and numbers is the only way to capitalize on Dubai's unprecedented growth.

Why Less Than 2% of Dubai Properties Have Direct Beach Access

Ali Faizan Syed explains the geographic scarcity driving Ultra Luxury prices: only 7% of Dubai is waterfront, and less than 2% has direct beach access. Learn how this rarity affects HNI investment strategy.

Dubai Real Estate Investment Guide

A complete Dubai real estate investment guide covering ROI, rental yields, strategies, and expert insights.

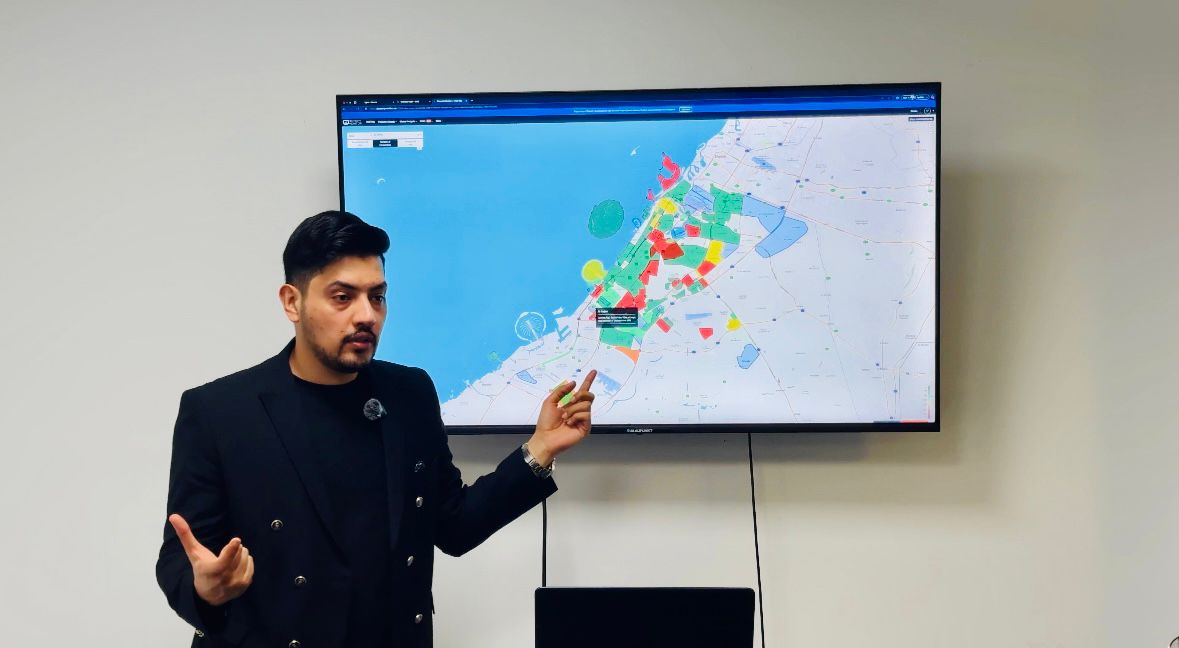

Top 10 Areas for Property Investment in Dubai

Discover the most promising neighborhoods in Dubai for real estate investment, analyzed by ROI potential, rental yields, and growth prospects.

Dubai Real Estate Market Outlook 2025

Comprehensive analysis of Dubai's real estate market trends, investment opportunities, and expert predictions for 2025.

Understanding Off-Plan Properties: Complete Guide

Everything you need to know about investing in off-plan properties in Dubai, from benefits to risks and how to choose the right project.