Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan

Investment Starts From

Starting from AED 4.5M

Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan - Key Facts

Developer

BEYOND (Division of Omniyat Group)

Location

West Crescent, Palm Jumeirah, Dubai

Starting Price

AED 4,500,000

Completion

2029-09-30

Property Type

Apartment

Investment Protection

RERA Escrow Protected

Price Range

AED 4,500,000 - AED 200,000,000

Expected ROI

9.2%

Project General Facts

Property Type

Apartment

Developer

BEYOND (Division of Omniyat Group)

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

THE EXECUTIVE AUDIT: ALI FAIZAN SYED (SCORE: 9.2/10)

I define a 'Trophy Asset' not by its chandelier count, but by its Irreplaceability Ratio. In the context of Dubai real estate, land is generally abundant. However, the West Crescent of the Palm Jumeirah is a finite resource. There is no more land to reclaim. Passo sits on the final prime plot of this specific coastline, creating a permanent supply cap.

My verdict is mathematical: We are currently seeing transactions at Atlantis The Royal (next door) clearing at AED 9,000 to AED 11,000 per square foot. Passo is launching at an average of AED 6,600 per square foot. This creates an immediate 'Location Arbitrage' of approximately 30 percent. Buying here is not speculation; it is buying the exact same view corridor and beach access as the most expensive address in Dubai, but at a wholesale entry price.

Furthermore, the 60/40 Payment Plan (40% on handover in Q3 2029) allows us to control this high-value asset with managed cash flow, hedging against the inflation of prime waterfront land while securing a legacy position in the most resilient sub-market in the UAE.

THE LOCATION THESIS (THE GOLD COAST)

The West Crescent Monopoly

The West Crescent is the 'Billionaire's Row' of the Palm. It is home to the Kempinski, the Raffles (formerly Emerald Palace), and the W Hotel. But the crown jewel is Atlantis The Royal. Passo is situated directly adjacent to this ecosystem. Why does this matter? Because real estate values are contagious. The ultra-high transaction volume of Atlantis lifts the valuation floor for every neighboring plot. By owning Passo, you are drafting behind the marketing power of a global hospitality icon without paying the hospitality premium.

The 250 Meter Private Beach

Most 'beachfront' developments in Dubai suffer from overcrowding. Passo controls a dedicated 250-meter private beach for just 625 units. This ratio of 'Beach-per-Resident' is significantly higher than the JBR or Emaar Beachfront clusters. For the end-user, this translates to privacy. For the investor, this translates to tenant retention. High-net-worth tenants leave properties because of privacy invasion; Passo solves this structural flaw.

THE ARCHITECTURE & PRODUCT MIX

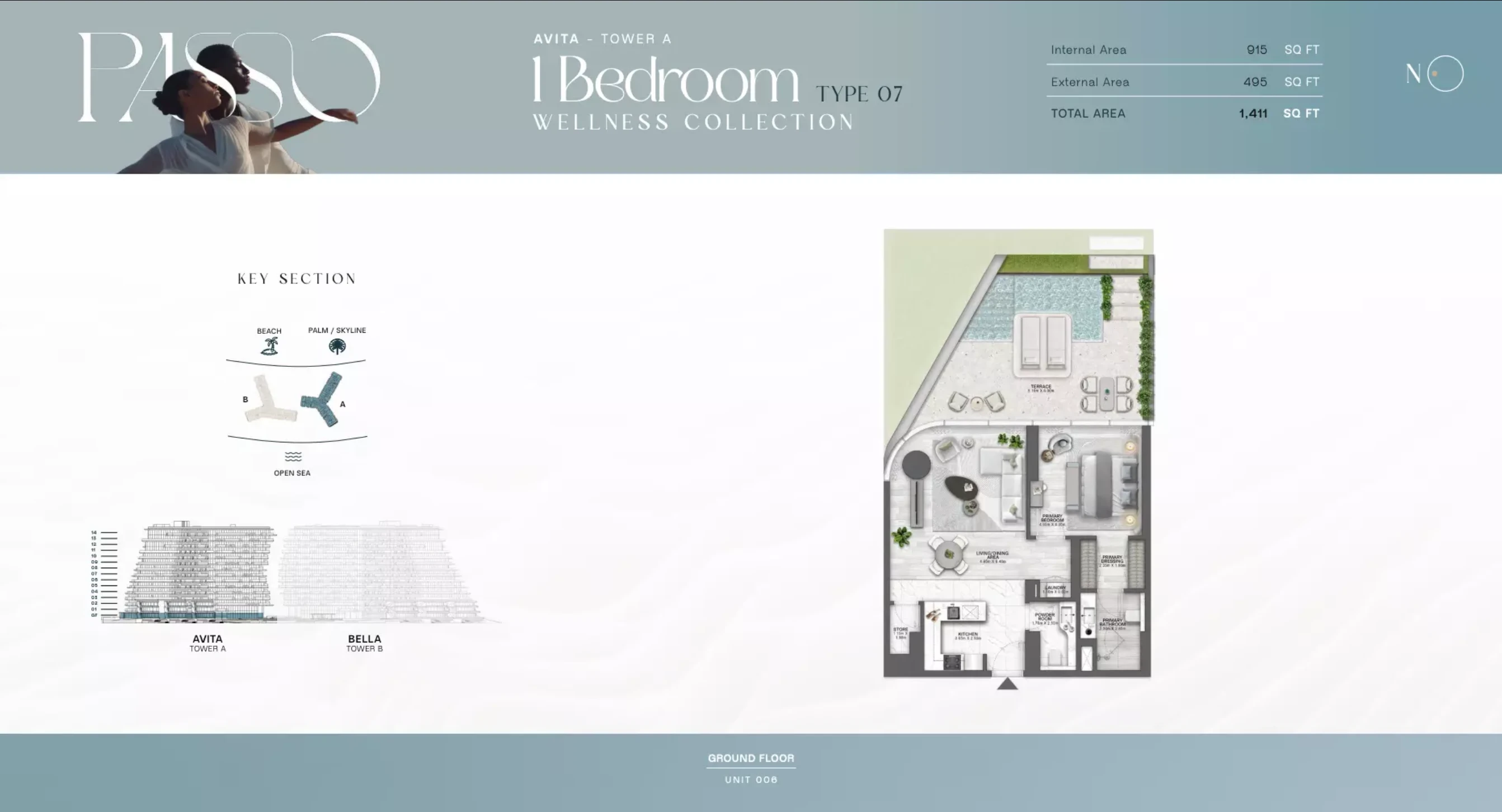

The Ocean Mansions (G+3 Concept)

Beyond has introduced a typology rarely seen in vertical towers: The Ground Floor Ocean Mansion. These are not standard apartments. They feature private pools, direct garden access, and a layout that mimics a standalone villa. I classify these as 'Unicorn Units.' They appeal to a specific demographic of wealthy families who refuse to use elevators but demand the security and facility management of a tower. These units will trade at a massive premium in the secondary market due to zero competition.

The 'Elite' vs 'Elegant' Collection

The project is split into two distinct specifications. The 'Elite' collection offers larger floor plates, maid's rooms, and premium positioning. My audit suggests the Elite units are the 'Safe Haven' asset for capital preservation, while the smaller 'Elegant' units offer higher rental velocity for yield-focused investors.

THE INVESTMENT MATH (ARBITRAGE)

The Price Gap Analysis

Let us look at the hard data. A 2-bedroom unit in Atlantis The Royal rents for approximately AED 1.7 Million per year. A similar size unit in Passo will cost you roughly AED 9-10 Million to buy. Even if we project a conservative rental rate of AED 800,000 for Passo (50 percent of Atlantis), you are looking at a Gross Yield of 8 percent on a Super Prime asset. This is an anomaly. Usually, Super Prime yields compress to 4-5 percent. Passo offers 'Growth' returns with 'Yield' cash flow.

The 2029 Maturity Curve

By the time Passo hands over in Q3 2029, the Palm Jebel Ali will still be in heavy construction. This means for the next decade, Palm Jumeirah remains the undisputed, completed, and operational king of luxury. There is no dilution risk from new supply on *this* island. You are holding a completed monopoly card while the rest of the market speculates on future projects.

THE DEVELOPER AUDIT (BEYOND / OMNIYAT)

In the off-plan market, your primary risk is the developer's ability to deliver quality that matches the brochure. BEYOND operates under the Omniyat Group umbrella. I have tracked Omniyat's resale performance on 'One Palm' and 'The Opus.' Their units consistently resell at the top of the market because they do not 'Value Engineer' (cut costs) on the finishes. They use natural stone, high-grade acoustic glass, and European joinery. Investing in Beyond is an investment in 'Resale Dignity' the asset will age gracefully, protecting your exit price.

Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan - Pros & Cons Analysis

Balanced investment assessment by Ali Faizan Syed

Advantages

- Premium development by BEYOND (Division of Omniyat Group)

- Strategic location in West Crescent, Palm Jumeirah, Dubai

- RERA-approved escrow protection

- Flexible payment plans available

- High ROI potential based on market analysis

Considerations

- Off-plan completion timeline may vary

- Market conditions can affect final valuation

- Additional DLD fees apply (4%)

- Premium pricing compared to secondary market

Based on comprehensive market analysis, Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan presents a favorable investment opportunity. The advantages outweigh typical off-plan considerations, making it suitable for investors seeking West Crescent, Palm Jumeirah, Dubai market exposure.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Natural Honed Stone

Window Type

Floor-to-Ceiling Acoustic Glass

Ali Faizan Syed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 510M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of BEYOND (Division of Omniyat Group)'s proven track record, West Crescent, Palm Jumeirah, Dubai's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- I advise my UHNW clients to view Passo as a Final Piece in their Dubai portfolio. The Palm Jumeirah is a finite resource; there are no more plots on the West Crescent. This is not a speculation play; it is a legacy play. By securing a unit here at AED 6,600 PSF, you are effectively buying at the wholesale price of Ultra Luxury, with a clear path to AED 9,000 PSF upon maturity based on current transaction data from neighboring Atlantis The Royal. This is an arbitrage opportunity created by the pre launch pricing strategy.

- I project a Capital Value Alignment where Passo catches up to the pricing of Atlantis The Royal, offering a 25 to 30 percent capital appreciation by 2029. Rental yields will be premium, estimated at 6 to 8 percent net, driven by the scarcity of high end, new build stock on the Palm. The ability to command high short term rental rates during the peak winter season provides an additional yield kicker.

- This asset is designed for the Security Investor and the Global Elite seeking a trophy asset. It is ideal for those who already hold property in London, New York, or Monaco and understand the value of Irreplaceable Locations. It is also suitable for Family Offices looking to park capital in a high appreciation, inflation hedging asset class that offers personal usage utility.

- The location risk is effectively zero as the Palm is an established, globally recognized destination. The developer risk is minimal given Omniyat track record. The only variable is market cycle timing, but this is heavily hedged by the absolute scarcity of the asset. We are buying the last piece of land on the most valuable strip of real estate in the region.

Risk Mitigation Strategy

- The location risk is effectively zero as the Palm is an established, globally recognized destination. The developer risk is minimal given Omniyat track record. The only variable is market cycle timing, but this is heavily hedged by the absolute scarcity of the asset. We are buying the last piece of land on the most valuable strip of real estate in the region.

- Risk Level: Low

- I have analyzed the transaction data for the entire Crescent for the last decade. Properties here do not depreciate; they re baseline higher after every market cycle due to the physical impossibility of adding more supply. I have helped clients acquire similar assets in One Palm, and they have seen their equity double as the project moved from off plan to handover.

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Location

The West Crescent is the Gold Coast of Dubai. Being neighbor to Atlantis The Royal guarantees a valuation floor. There is no more land to be reclaimed here, making this a finite, deflationary asset in an inflationary world. The views of the open sea and the Dubai skyline are protected and permanent.

Developer

Beyond operates with Institutional Grade quality control. The asset will maintain its physical integrity for decades. Unlike mass market developers who cut costs on hidden mechanical systems, Beyond invests in the longevity of the building, ensuring that service charges remain efficient and the facade does not degrade in the marine environment.

ROI

We are playing the Arbitrage Game buying at AED 6.6k PSF in a neighborhood trading at AED 9k plus PSF. This 30 percent value gap is our margin of safety. As the project rises and the physical structure becomes visible, this gap will close, generating significant equity growth for early investors before the key is even turned.

Market Timing

With Palm Jebel Ali years away from habitability, Palm Jumeirah remains the undisputed king of luxury for the next decade. The demand for ready, high spec property on the Palm is at an all time high, and supply is constrained. Launching into this supply vacuum positions Passo perfectly to capture the overflow demand from Atlantis.

Infrastructure

The Crescent road network is mature. You are not buying into a construction site; you are buying into a finished resort destination. The connectivity is seamless, and the lifestyle infrastructure fine dining, retail, beach clubs is already operational and world class. You step into a fully functioning luxury ecosystem from day one.

Amenities

The 250m private beach is the key differentiator. Most beachfront projects share access or have public beaches; Passo owns its coastline. This exclusivity allows for a true resort experience without the crowds. Combined with the private wellness facilities, it creates a lifestyle moat that protects rental and resale value.

Who Should Invest in This Property?

This asset is designed for the Security Investor and the Global Elite seeking a trophy asset. It is ideal for those who already hold property in London, New York, or Monaco and understand the value of Irreplaceable Locations. It is also suitable for Family Offices looking to park capital in a high appreciation, inflation hedging asset class that offers personal usage utility.

My Personal Experience with Similar Projects

I have analyzed the transaction data for the entire Crescent for the last decade. Properties here do not depreciate; they re baseline higher after every market cycle due to the physical impossibility of adding more supply. I have helped clients acquire similar assets in One Palm, and they have seen their equity double as the project moved from off plan to handover.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠1 Bedroom Residence1br

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

1 Bedroom Residence

1

AED 4,500,000

2 Bedroom Panoramic

2

AED 8,500,000

Ground Floor Ocean Mansion

3

AED 15,000,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 4,500,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

Comprehensive Location Analysis

Deep dive into West Crescent, Palm Jumeirah, Dubai's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding BEYOND (Division of Omniyat Group)'s track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing West Crescent, Palm Jumeirah, Dubai's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

West Crescent, Palm Jumeirah, Dubai

Open in Maps App

Coordinates: 25.130500, 55.117000

Nearby Attractions & Amenities

Explore what makes West Crescent, Palm Jumeirah, Dubai exceptional

away

Atlantis The Royal

away

Nakheel Mall

away

Dubai Marina

How to Invest in Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan

Step-by-step guide to investing in Passo at Palm Jumeirah | The Strategic Asset Audit by Ali Faizan by BEYOND (Division of Omniyat Group)

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 450,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

If You Missed Dubai Hills in 2015, Read This: Why The Heights is Your Second Chance

We all have that one story: "I could have bought a Sidra villa for 3 Million." Today, that villa is 7 Million. The Heights in Dubai South is flashing the exact same signals Dubai Hills did a decade ago. Don't let history leave you behind again.

BREAKING: EOI Collection Officially Opens for The Heights Phase 2 (Serro & Salva)

The green light is on. Emaar has officially instructed brokers to start collecting Expressions of Interest (EOI) for the new Serro and Salva clusters. This is not a drill. If you want a unit, the paperwork needs to be submitted *today*.

The Dubai South "Super-Cycle": Why Emaar Waited for +24% Growth to Relaunch The Heights

Why sell for AED 900 PSF in 2023 when you can sell for AED 1,600 PSF in 2025? The data is out. Dubai South has appreciated by 24.41% in the last year alone. Here is why Emaar's "cancellation" was the smartest strategic move of the decade.

Frequently Asked Questions

Project-specific questions and answers

General

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.