A common concern I hear from international investors involves the longevity of Dubai's concrete jungle. Many "pill giver" brokers avoid the topic of building age, but as a data certified consultant, I believe in surgical transparency. There is a lingering myth that buildings in Dubai have an average life of only 25 years. In reality, the average life of a modern building is between 50 and 100 years, provided it is managed by a credible developer and follows municipality guidelines. Understanding the difference between building age and the legal structure of ownership is vital for building a generational legacy.

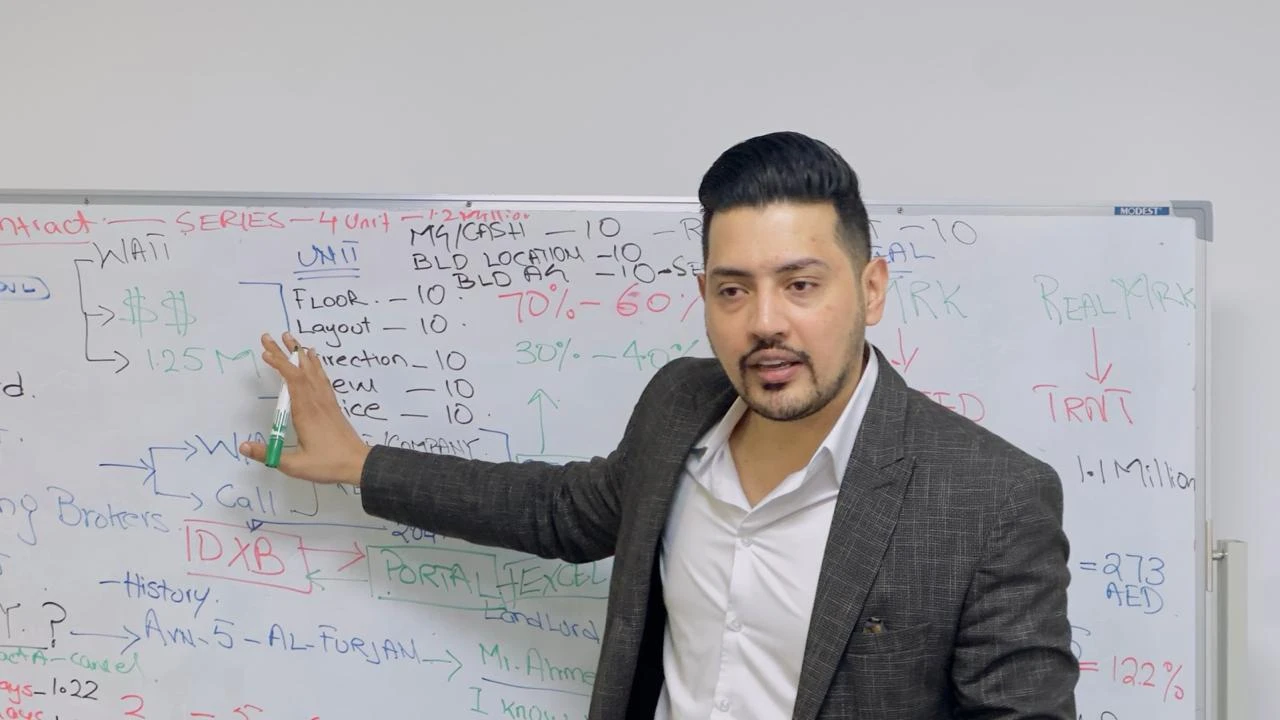

The Refurbishment Reality

Buildings in Dubai do not simply disappear after 25 years. Look at communities like Discovery Gardens or Karama. While these are some of the older developments in the city, they are continuously refurbished and maintained. Developers provide a 10 year structural warranty, and municipality inspections ensure that the materials used, especially iron and concrete, meet the world's highest standards. If a building is properly managed, it can remain a high performing rental asset for decades.

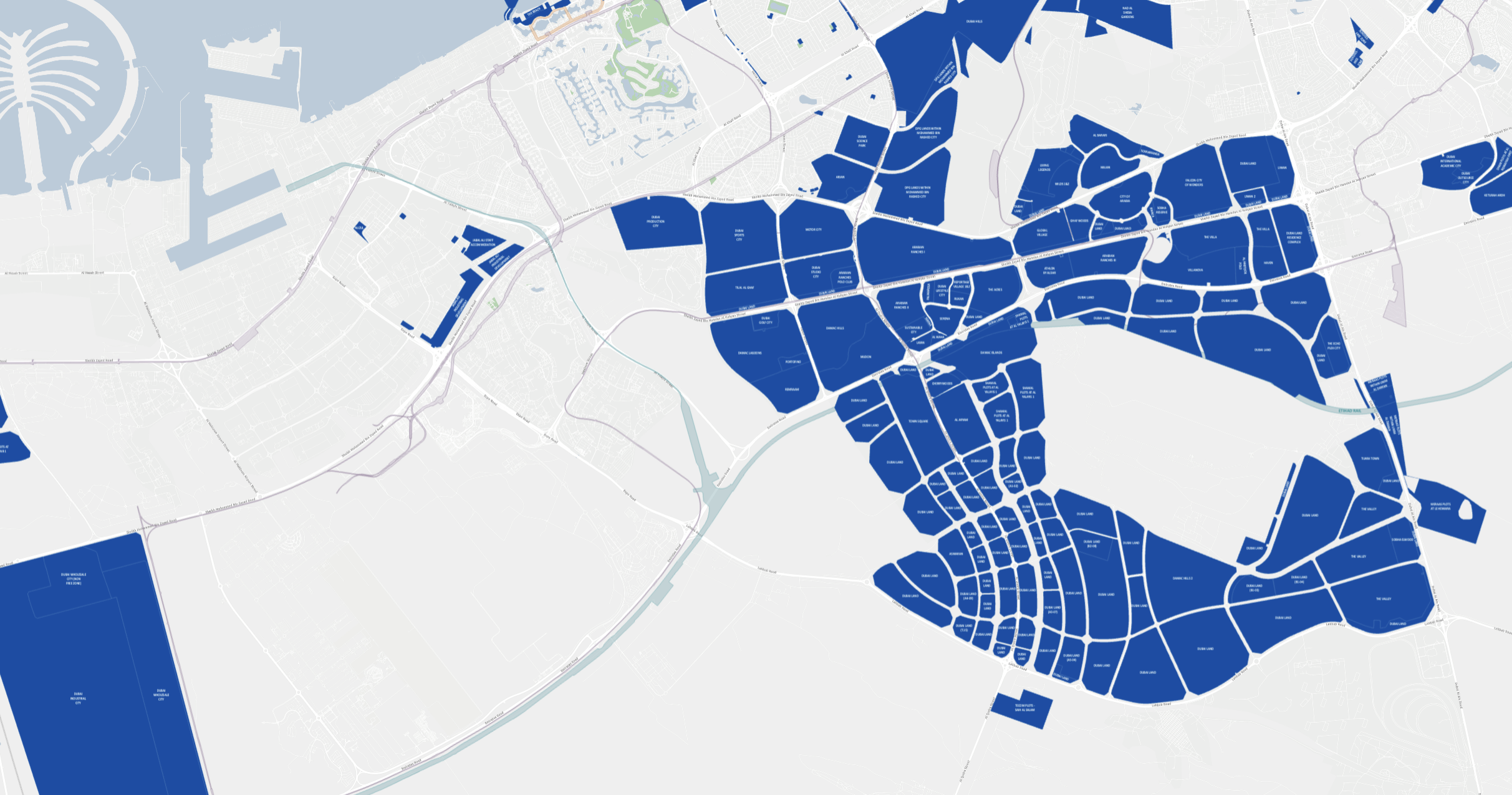

Freehold vs. Leasehold: The 99 Year Rule

In Dubai, ownership is categorized into two types: Freehold and Leasehold. For expatriates, freehold ownership means you own the property and the land it sits on for a confirmed period, which is often referred to as 99 years. However, this is functionally equivalent to permanent ownership because the government allows for the conversion of land and the passing of deeds through generations. Leasehold, on the other hand, means you are essentially renting the right to live in the building from a local landlord or the government for a specific duration.

The Villa Legacy: Owning the Dirt

The ultimate strategy for generational wealth is the Villa Play. While an apartment owner possesses the unit within a building, a villa owner owns the land. This means that even if the building itself reaches the end of its life cycle in 80 years, the plot remains yours to rebuild or pass down to your children. This is the primary reason why villas and townhouses represent only 17.4% of the total inventory: they are the city's most permanent and prestigious assets.

Planning for 2089

When I perform a financial CT scan for a client, I ask them to think about their exit strategy. A building that is 15 years old might see a slight rental correction because tenants prefer the latest technology and amenities in newer handovers. The smartest move is to hold a property during its peak performance years and then liquidate or upgrade before the depreciation curve becomes too steep. In Dubai, the market is young and energetic, meaning we have the leverage to cycle capital into new opportunities every 5 to 10 years.