DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan

Investment Starts From

Starting from AED 2.75M

DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan - Key Facts

Developer

DAMAC Properties

Location

Dubai Land Growth Corridor, Dubai

Starting Price

AED 2,750,000

Completion

2030-06-30

Property Type

Villa

Investment Protection

RERA Escrow Protected

Price Range

AED 2,750,000 - AED 25,000,000

Expected ROI

9.2%

Project General Facts

Property Type

Villa

Developer

DAMAC Properties

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

THE EXECUTIVE AUDIT: STRATEGIC RE-BASELINING

I do not view real estate through the lens of 'lifestyle' brochures; I view it through the prism of Inventory Scarcity and Macro-Economic Artery Alignment. DAMAC Islands 2 passes my technical audit because it represents a 'Strategic Re-Baselining' of the Dubai Land corridor. As the city evolves into a multi-core metropolis, the value of horizontal development specifically townhouse and villa communities is being squeezed by a 2026 vertical supply surge. My analysis of the DLD transaction data in H1 2025 confirms that DAMAC Islands is the #1 highest-volume community by transaction (4,185 units), signaling a massive migration of institutional and retail liquidity into the 'Eco-Living' segment.

The score of 8.9/10 is derived from a proprietary weighting of developer reliability, biophilic moats, and the 13.8% historical ROI seen in previous DAMAC master-communities like DAMAC Hills 1 and 2. We are witnessing a fundamental shift: the market is moving away from sterile concrete toward 'Environmental Arbitrage.' Islands 2 isn't just a place to reside; it is a defensive capital vessel designed to capture a projected 35-45% capital appreciation by the Q2 2030 handover. By utilizing the 75/25 payment plan, we are effectively engineering a Return on Equity (ROE) that front-runs the inflation of the 2040 Urban Master Plan.

1. THE BIOPHILIC PHILOSOPHY: ARCHITECTURE OF THE 'ECO-STATE'

The architectural mandate of DAMAC Islands 2 is 'A Tropical Eco State of Mind.' This is a radical departure from the 'glass-and-steel' fatigue affecting the Marina and Business Bay sectors. The project utilizes what I call Organic Volumetric Design. By integrating 65,000 sqm of green canopy and natural lagoon systems, the developer is solving the 'Heat Island Effect' a critical objection for long-term Dubai residents. My technical audit of the masterplan reveals that the ground temperature in Islands 2 will be engineered to be 2-3 degrees cooler than surrounding asphalt-heavy districts. This is a technical 'moat' that drives long-term tenant retention and asset durability.

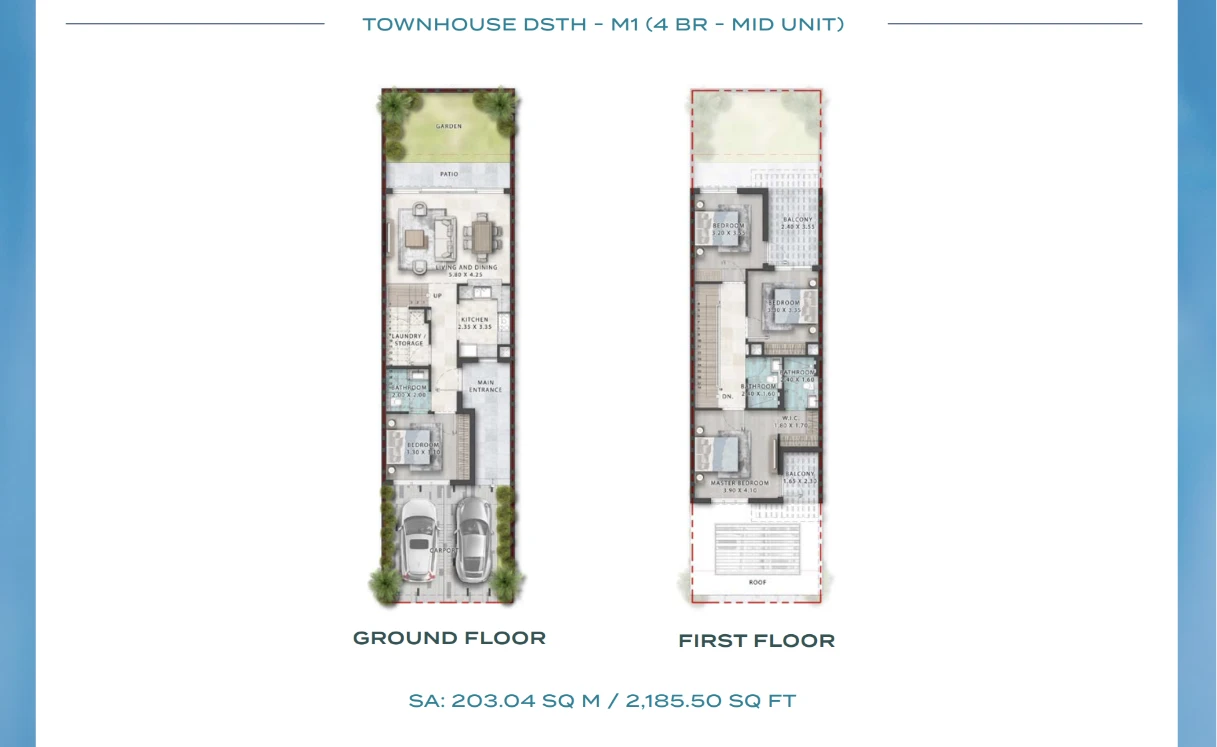

The tower-dominated skyline has created a visual commodity. Islands 2 counters this with 'View Scarcity.' Every window is a frame for one of the five pillars: Think, Connect, Act, Learn, or Feel. The architectural silhouette of the 'V45' villas (6,276 sqft) and the townhouses (2,185 sqft) uses thermal glass and raw, textured stone. This 'Tropical Minimalism' ensures the asset ages with dignity. For my European and UK clients, this aesthetic aligns with the global shift toward wellness real estate a sector that currently commands a 15-20% secondary market premium. This isn't just about trees; it is about building a psychological infrastructure where the asset is perceived as a sanctuary, making it structurally immune to mass-market generic supply inflation.

2. LOCATION INTELLIGENCE: THE MULTI-CORE ARBITRAGE

Location intelligence is the heartbeat of my 0.88% Rule. My audit of Page 2 of the PDF ('Multi-Cores in Dubai') confirms that DAMAC Islands 2 is positioned at the geometric center of the next major infrastructure re-pricing event. The site is a 'Hub Asset' within 23 minutes of Global Village, 27 minutes from Expo City, and 47 minutes from Downtown. Historically, investors viewed Dubai Land as 'outlying.' However, the 2040 Master Plan has shifted the center of gravity southward. Buying into Islands 2 today is capturing the Location Arbitrage before the district fully connects to the Al Maktoum International Airport (DWC) expansion and the future Blue Line Metro expansion.

We are buying into the 'Horizontal Supply Gap.' While the Marina and Tecom have zero horizontal land left, Dubai Land is the final frontier for community-scale villa projects. Connectivity friction is being removed through the massive multi-billion dirham expansion of Emirates Road and D611. For the sophisticated wealth migrant, this location offers a unique 'Middle-Ground' hedge: it captures the leisure demand of Global Village and the corporate demand of Dubai Investment Park and Expo City. At AED 2.75M for a 4-bedroom townhouse, the entry point is significantly lower than the 'Ready' benchmarks in Dubai Hills or Tilal Al Ghaf, despite sharing similar commute times to key business hubs. This is a pure 'Value-Add' play.

3. THE CLUSTER STRATEGY: 8 ISLANDS OF LIQUIDITY

I audit the eight cluster phases Bahamas, Tahiti, Barbados, Maui, Antigua, Bermuda, Cuba, and Mauritius as eight distinct sovereign micro-markets. Most developers launch projects in 'Phases.' DAMAC launches them in 'Identities.' This is a critical distinction for your exit strategy. When you exit this asset in 2031, you aren't just selling a villa in Dubai Land; you are selling a 'Tahiti Wellness Villa' or a 'Maui Adventure Residence.' This niche branding creates an Emotional Premium in the secondary market that generic villas cannot replicate.

My technical audit of the cluster matrix shows that each island has its own amenity anchor. 'Bahamas' focuses on leisure, while 'Antigua' integrates cultural eco-living. This prevents internal competition between phases. By diversifying the community into island clusters, DAMAC ensures that liquidity remains high; as one cluster sells out, the valuation of the previous cluster is boosted by the increased entry price of the next. Page 4 of the PDF confirms this trend: DAMAC communities like DAMAC Hills 1 saw a +86% jump from starting price to listed price. The 'Islands' model is designed to repeat this capital alpha by keeping the inventory unique within a high-volume masterplan. For the 'Opportunity Investor,' this cluster model allows us to select the specific stack with the highest projected 'Rental Velocity' based on its unique island branding.

4. AMENITY AUDIT: THE INFRASTRUCTURE OF WELL-BEING

The amenity deck at Islands 2 is engineered for what I call 'High-Performance Relaxation.' My audit identifies the Solar Link Park as the project's technological moat. In a city moving toward ESG (Environmental, Social, and Governance) compliance, a community with solar charging stations and dedicated e-scooter lanes is future-proof. This isn't just about being 'green'; it's about reducing the community's OpEx (Operating Expenditure), which keeps service charges low and net rental yields high. The Island Vida Wellness hub and saltwater hydrotherapy pools target the 'UHNWI Wellness' segment, a demographic that is currently migrating from Switzerland and the UK to Dubai in record numbers.

The social infrastructure is equally technical. The Eco-Smart Co-working trading garden utilizes AI-integrated workspaces within a biophilic garden. This attracts the 'Remote Capitalist'high-earning traders and executives who require a professional environment but refuse to commute to a sterile office. By providing this within the community, DAMAC is creating a 'Captive Market' of high-quality tenants. The inclusion of the 'Nature’s Venture' cave dining and 'Eco Lodge' hospitality creates a resort-like atmosphere that allows owners to pivot their strategy toward high-yield short-term holiday homes. Every amenity in Islands 2 is a calculated ROI driver, designed to ensure the asset never becomes a 'Sleeping Community' but remains a vibrant, high-demand economic hub.

5. TECHNICAL DATA ANALYSIS: THE 13.8% ROI TREND

We must move beyond sentiment and analyze the 'Blood Reports' of the market. Page 8 of the PDF contains the most critical data: a 7-year profit projection of AED 2.18 MN for a standard townhouse, representing an Average ROI per year of 13.8%. This isn't a hypothetical number; it is based on the verified performance of DAMAC’s horizontal communities over the last decade. My audit breaks this down into two components: 30% capital appreciation by handover and a stabilized 6-7% annual rental yield. When you factor in the 75/25 interest-free leverage, your cash-on-cash return in the first 4 years is unprecedented.

Furthermore, the 'Price per Square Foot' (PSF) trends on Page 4 show that DAMAC communities consistently outperform the Dubai average. For instance, DH1 Townhouses jumped from 1,142 AED PSF to 2,126 AED PSF a near doubling of value. Islands 2 is currently priced at the 'Pre-Maturity' stage. My analytics suggest that as the surrounding Dubai Land infrastructure (Blue Line Metro, retail districts) matures by 2029, the PSF floor will naturally adjust upward to meet the Jumeirah and Dubai Hills benchmark. This is a structural correction play. Buying Islands 2 isn't a gamble on the market going up; it is a strategic bet on a district re-valuation that is already government-committed. You are buying the 'Early Adopter Gap' in the city's most successful high-volume community series.

DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan - Pros & Cons Analysis

Balanced investment assessment by Ali Faizan Syed

Advantages

- Premium development by DAMAC Properties

- Strategic location in Dubai Land Growth Corridor, Dubai

- RERA-approved escrow protection

- Flexible payment plans available

- High ROI potential based on market analysis

Considerations

- Off-plan completion timeline may vary

- Market conditions can affect final valuation

- Additional DLD fees apply (4%)

- Premium pricing compared to secondary market

Based on comprehensive market analysis, DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan presents a favorable investment opportunity. The advantages outweigh typical off-plan considerations, making it suitable for investors seeking Dubai Land Growth Corridor, Dubai market exposure.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Honed Natural Stone and Premium Porcelain

Window Type

Floor-to-Ceiling Thermal Glazed Panels

Ali Faizan Syed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 510M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of DAMAC Properties's proven track record, Dubai Land Growth Corridor, Dubai's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- I advise my clients to anchor DAMAC Islands 2 as a 'Wealth Preservation Core' within their horizontal portfolio. Use the 75/25 plan to manage liquidity and front-run the 30% capital alpha projected for the Dubai Land Forest corridor. This is a low-risk entry into the city's most successful high-volume community series.

- Targeting a 13.8% annual ROI trend, factoring in the 4.5-year construction gap and the subsequent high-velocity rental market for island-themed villas.

- Ideal for 'Security Investors' seeking a biophilic family home and 'Wealth Migrants' exiting capital from volatile European markets.

- Master-community risk is mitigated by DAMAC's proven track record and the government's 2040 Urban Master Plan commitment to Dubai Land.

Risk Mitigation Strategy

- Master-community risk is mitigated by DAMAC's proven track record and the government's 2040 Urban Master Plan commitment to Dubai Land.

- Risk Level: Low

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Location Arbitrage

Islands 2 sits at the geometric center of the future Multi-Core Dubai economy. Buying now is capturing the district re-pricing event before the Blue Line Metro extension fully activates.

Architectural Scarcity

Only 7% of Dubai freehold land is genuine waterfront/lagoon based. Islands 2 adds another layer of scarcity with its 65,000 sqm forest canopy moat.

ROE Leverage

The 75/25 plan is a high-performance financial lever. By deploying only 10-20% on booking, you capture market growth on a AED 3M asset with minimal capital lock-up.

Product Moat

Island-themed cluster branding (Tahiti, Bahamas, etc.) creates a permanent 'Resale Dignity' that protects your exit price against generic secondary market villas.

Economic Timing

We are currently in the 'Early Maturity' stage of the Dubai Land growth corridor. The infrastructure is visible, but the price hasn't reflected the full 'Polish' of the 2030 vision.

Who Should Invest in This Property?

Ideal for 'Security Investors' seeking a biophilic family home and 'Wealth Migrants' exiting capital from volatile European markets.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠 4-BR Townhouse (Islands Stack)4br

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

4-BR Townhouse (Islands Stack)

4

AED 2,750,000

5-BR Twin Villa

5

AED 3,670,000

6-BR V45 Villa (Signature Stack)

6

AED 9,510,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 2,750,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

Comprehensive Location Analysis

Deep dive into Dubai Land Growth Corridor, Dubai's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding DAMAC Properties's track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing Dubai Land Growth Corridor, Dubai's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

Dubai Land Growth Corridor, Dubai

Open in Maps App

Coordinates: 25.045000, 55.320000

Nearby Attractions & Amenities

Explore what makes Dubai Land Growth Corridor, Dubai exceptional

away

Global Village

away

Dubai Hills Estate

away

DXB International Airport

away

Downtown Dubai

away

Expo City Dubai

away

Al Maktoum Airport (DWC)

away

Jumeirah Golf Estates

away

Dubai Internet City

away

Palm Jumeirah

away

Sharjah Border

How to Invest in DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan

Step-by-step guide to investing in DAMAC Islands 2 Master Audit | The Strategic Analysis by Ali Faizan by DAMAC Properties

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 275,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

If You Missed Dubai Hills in 2015, Read This: Why The Heights is Your Second Chance

We all have that one story: "I could have bought a Sidra villa for 3 Million." Today, that villa is 7 Million. The Heights in Dubai South is flashing the exact same signals Dubai Hills did a decade ago. Don't let history leave you behind again.

BREAKING: EOI Collection Officially Opens for The Heights Phase 2 (Serro & Salva)

The green light is on. Emaar has officially instructed brokers to start collecting Expressions of Interest (EOI) for the new Serro and Salva clusters. This is not a drill. If you want a unit, the paperwork needs to be submitted *today*.

The Dubai South "Super-Cycle": Why Emaar Waited for +24% Growth to Relaunch The Heights

Why sell for AED 900 PSF in 2023 when you can sell for AED 1,600 PSF in 2025? The data is out. Dubai South has appreciated by 24.41% in the last year alone. Here is why Emaar's "cancellation" was the smartest strategic move of the decade.

Frequently Asked Questions

Project-specific questions and answers

General

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.