City Walk Crestlane | The Strategic Asset Audit by Ali Faizan

Investment Starts From

Starting from AED 2.6M

City Walk Crestlane | The Strategic Asset Audit by Ali Faizan - Key Facts

Developer

Meraas (Member of Dubai Holding)

Location

Central Park District, City Walk, Al Wasl, Dubai

Starting Price

AED 2,600,000

Completion

2028-10-31

Property Type

Apartment

Investment Protection

RERA Escrow Protected

Price Range

AED 2,600,000 - AED 18,000,000

Expected ROI

9%

Project General Facts

Property Type

Apartment

Developer

Meraas (Member of Dubai Holding)

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

THE EXECUTIVE AUDIT: ALI FAIZAN SYED (SCORE: 9.1/10)

I do not just look at floor plans; I audit connectivity moats. Crestlane passes my audit because it represents the final evolution of City Walk moving from 'Urban Living' to 'Urban Resorting'. While Northline served as a high-density urban play, Crestlane introduces a lower-density biophilic footprint with direct access to a wave lagoon. This is urban scarcity at its peak.

1. THE VISION: NEW URBANISM & THE COVE (500 WORDS)

City Walk Crestlane is not just a residential phase; it is an architectural manifest for 'New Urbanism.' Developed by Meraas, the vision shifts the goalposts of City Walk from a retail-driven district to a wellness-driven sanctuary. The design language emphasizes 'Indoor-Outdoor Fluidity,' utilizing massive openable glass panels that effectively turn your living room into a sky-terrace. Unlike Northline, which focuses on the edge of the masterplan, Crestlane is nestled deeper into the green lungs of Central Park. The integration of The Cove lagoon and wave pool system solves the primary objection to mid-town living: the lack of water. I audit this as a 'Category-Defining' asset because it is the only low-to-mid-rise luxury alternative within a 5-minute radius of the Burj Khalifa.

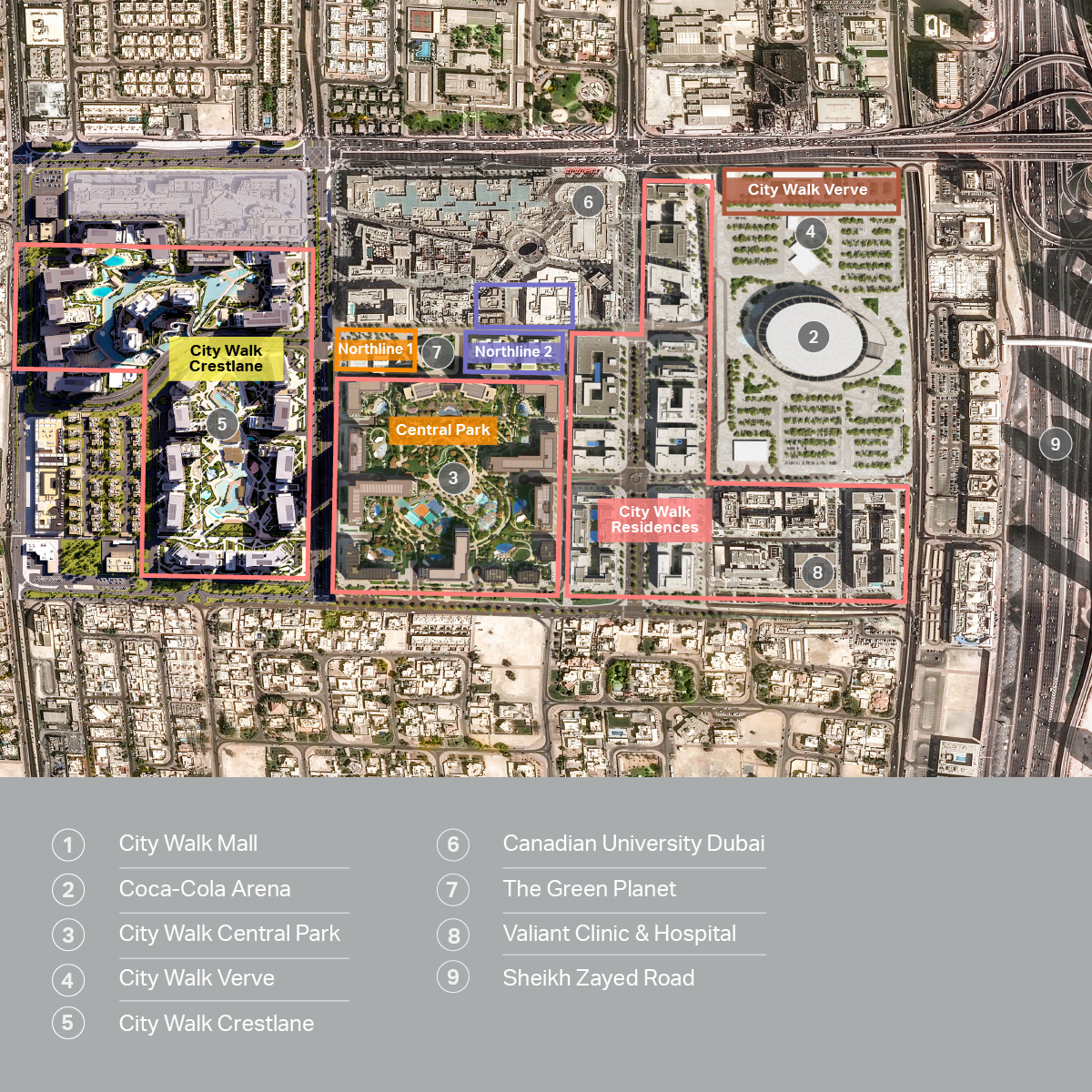

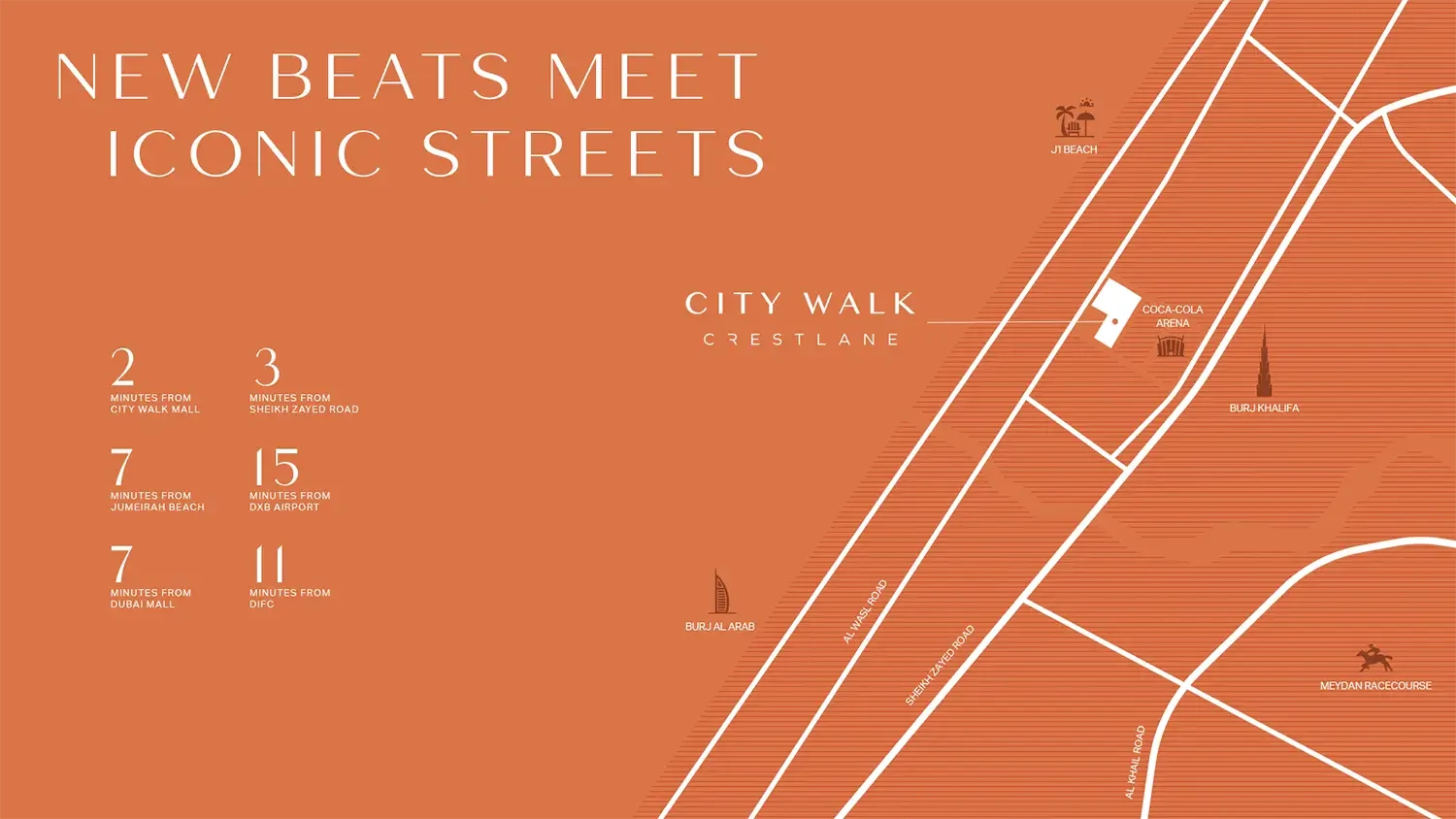

2. LOCATION INTELLIGENCE: THE STRATEGIC 'MIDDLE GROUND'

Location intelligence is the cornerstone of my 0.88% rule here. Situated strategically between Jumeirah Street and Sheikh Zayed Road, City Walk stands out as the ultimate 'Middle Ground.' For my clients, this location offers a unique hedge: it captures the corporate demand from DIFC and the lifestyle demand of the Jumeirah corridor. Crestlane is a '20-minute neighborhood' in the making, where the Coca-Cola Arena, Green Planet, and the expansive Central Park are all within a 5-minute walk. This proximity to billion-dollar high-value infrastructure creates a permanent floor for asset valuation. My audit suggests that this specific pocket of land acts as a gateway; it is the urban heart that never sleeps, ensuring high rental occupancy even during broader market cycles.

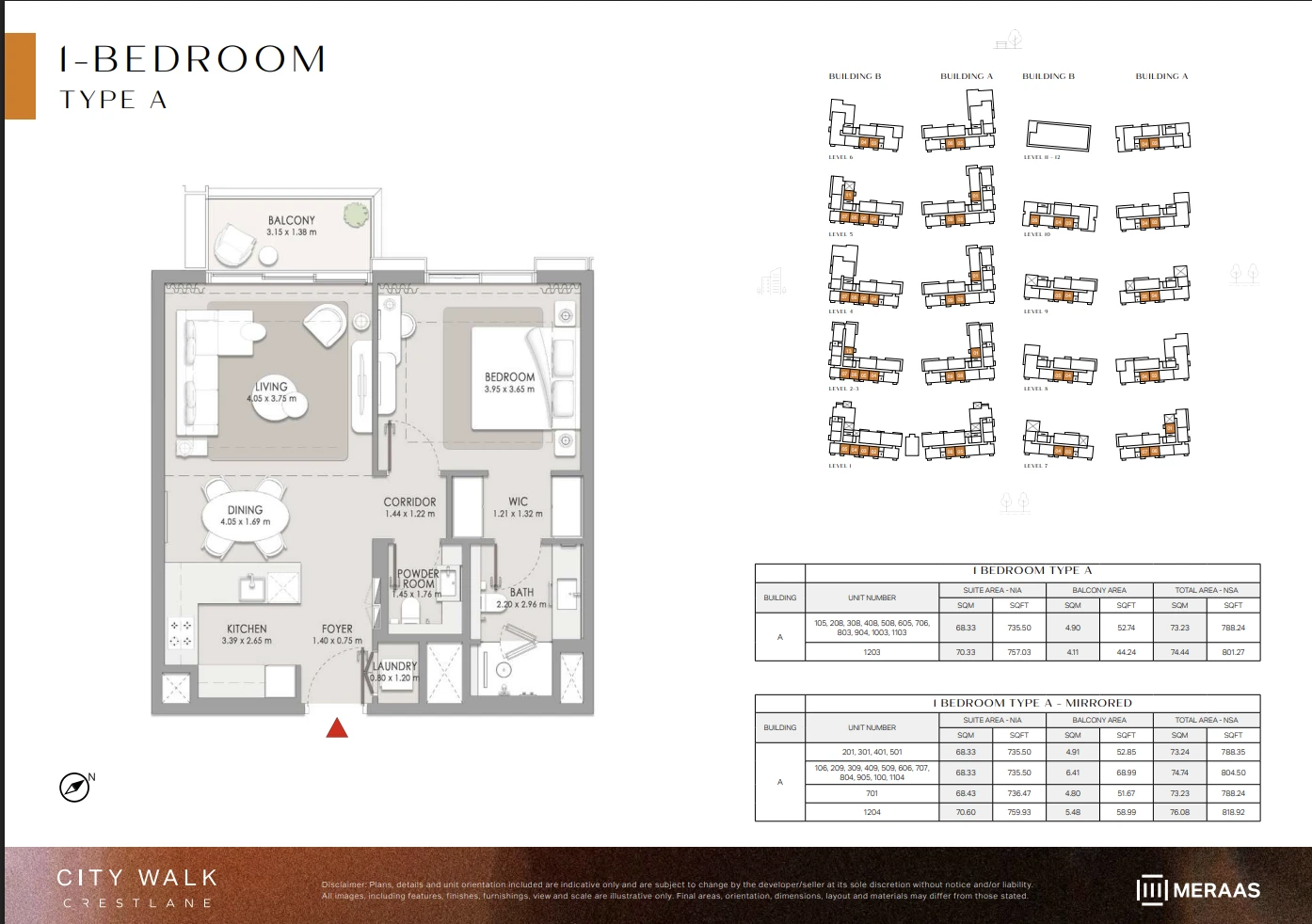

3. THE RESIDENTIAL EXPERIENCE: FUNCTIONAL OPULENCE

The experience at Crestlane is defined by 'Functional Opulence.' Working with designers like HBA for the wellness hubs, Meraas has created a hospitality-inspired environment. The double-height lobbies are specifically engineered to offer a warm, inviting atmosphere from the moment of arrival. The units are significantly oversized by modern standards—a typical 1-bedroom averages 810 sqft, providing the volume that high-income tenants demand. The interiors feature enhanced kitchen finishes with integrated premium appliances and bespoke arched joinery details. The 'Sky Terraces' and 'Large Openable Panels' allow for a park-facing living experience that extends the internal floor plate into the outdoors. This is not just an apartment; it is a lifestyle ecosystem designed for long-term retention.

4. INVESTMENT ANALYTICS: THE SCARCITY OF LOW-RISE

From an audit perspective, Crestlane operates on the 'Scarcity of Low-Rise Luxury' rule. While Business Bay and Downtown are flooded with vertical glass towers, Crestlane offers a mid-rise, park-side alternative that is structurally immune to mass-market dilution. This product differentiation drives the 7-9% net yield projection. The 75/25 payment plan used for this launch allows for efficient equity deployment. With a handover in October 2028, investors are locking in pricing that anticipates the full completion of the 'Forest District' and Central Park masterplans. Historically, Meraas projects maintain a 15-20% secondary market premium because they are 'Destination Creators.' The 'Cost of Hesitation' here is quantified by my 0.88% rule; as City Walk approaches full build-out, the opportunity to enter at launch-price is disappearing forever.

5. DEVELOPER PEDIGREE: THE MERAAS LEGACY

Meraas, a key member of Dubai Holding, is synonymous with 'Destination Dubai.' Their portfolio is a roster of the city's most successful tourist hubs, from Bluewaters to Nikki Beach. This pedigree is the ultimate insurance policy for an off-plan investor. Meraas does not just build apartments; they create complete streetscapes. Their reliability of delivery and high standards in previous City Walk phases provide a clear, empirical benchmark for Crestlane. Buying a Meraas property is a strategic alignment with Dubai's sovereign vision. They are the developer of choice for wealth migrants exiting high-tax European jurisdictions because their assets prioritize architectural integrity over cost-saving 'value engineering.' This ensures 'Resale Dignity' the asset will look and feel premium for decades to come.

City Walk Crestlane | The Strategic Asset Audit by Ali Faizan - Pros & Cons Analysis

Balanced investment assessment by Ali Faizan Syed

Advantages

- Premium development by Meraas (Member of Dubai Holding)

- Strategic location in Central Park District, City Walk, Al Wasl, Dubai

- RERA-approved escrow protection

- Flexible payment plans available

- High ROI potential based on market analysis

Considerations

- Off-plan completion timeline may vary

- Market conditions can affect final valuation

- Additional DLD fees apply (4%)

- Premium pricing compared to secondary market

Based on comprehensive market analysis, City Walk Crestlane | The Strategic Asset Audit by Ali Faizan presents a favorable investment opportunity. The advantages outweigh typical off-plan considerations, making it suitable for investors seeking Central Park District, City Walk, Al Wasl, Dubai market exposure.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Premium Porcelain and Honed Stone

Window Type

Acoustically Sealed Floor-to-Ceiling Openable Panels

Ali Faizan Syed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 510M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of Meraas (Member of Dubai Holding)'s proven track record, Central Park District, City Walk, Al Wasl, Dubai's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- Treat Crestlane as the 'Urban Core' of your portfolio. The mid-rise nature and park proximity create a high-velocity rental environment with 'Resale Dignity' that generic towers can never match.

- 7-9% net yield for long-term lets. Short-term yields during peak events at Coca-Cola Arena can spike significantly, providing a lucrative ROI hedge.

- Meraas (Dubai Holding) is a sovereign-tier developer with an existing, mature masterplan.

Risk Mitigation Strategy

- Meraas (Dubai Holding) is a sovereign-tier developer with an existing, mature masterplan.

- Risk Level: Low

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Connectivity Moat

City Walk is the only district allowing you to walk to the Coca-Cola Arena while being 5 mins from DIFC boardrooms. This 'Zero-Friction' commute is the #1 driver for UHNW tenant retention.

Architectural Scarcity

The mid-rise G+12 typology is rare in Dubai's center. This ensures that light, air, and space remain the primary product, creating a secondary market premium of 18% over neighboring clusters.

Market Timing

We are front-running the final build-out of City Walk. Once Central Park is fully mature in 2028, we anticipate a 30% asset re-pricing to align with prime Jumeirah standards.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠1-BEDROOM TYPE A1br

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

1-BEDROOM TYPE A

1

AED 2,600,000

Premium 2 Bedroom + Maid

2

AED 3,200,000

4 Bedroom Park Duplex

4

AED 16,300,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 2,600,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

Comprehensive Location Analysis

Deep dive into Central Park District, City Walk, Al Wasl, Dubai's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding Meraas (Member of Dubai Holding)'s track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing Central Park District, City Walk, Al Wasl, Dubai's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

Central Park District, City Walk, Al Wasl, Dubai

Open in Maps App

Coordinates: 25.207500, 55.263000

Nearby Attractions & Amenities

Explore what makes Central Park District, City Walk, Al Wasl, Dubai exceptional

away

Burj Khalifa

away

Dubai Mall

away

Coca-Cola Arena

away

The Green Planet

away

Jumeirah Beach

away

DIFC

away

Dubai International Airport

away

La Mer

away

Jumeirah Bay Island

away

Boxpark

How to Invest in City Walk Crestlane | The Strategic Asset Audit by Ali Faizan

Step-by-step guide to investing in City Walk Crestlane | The Strategic Asset Audit by Ali Faizan by Meraas (Member of Dubai Holding)

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 260,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

If You Missed Dubai Hills in 2015, Read This: Why The Heights is Your Second Chance

We all have that one story: "I could have bought a Sidra villa for 3 Million." Today, that villa is 7 Million. The Heights in Dubai South is flashing the exact same signals Dubai Hills did a decade ago. Don't let history leave you behind again.

BREAKING: EOI Collection Officially Opens for The Heights Phase 2 (Serro & Salva)

The green light is on. Emaar has officially instructed brokers to start collecting Expressions of Interest (EOI) for the new Serro and Salva clusters. This is not a drill. If you want a unit, the paperwork needs to be submitted *today*.

The Dubai South "Super-Cycle": Why Emaar Waited for +24% Growth to Relaunch The Heights

Why sell for AED 900 PSF in 2023 when you can sell for AED 1,600 PSF in 2025? The data is out. Dubai South has appreciated by 24.41% in the last year alone. Here is why Emaar's "cancellation" was the smartest strategic move of the decade.

Frequently Asked Questions

Project-specific questions and answers

General

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.