Jumeirah Village Circle (JVC) is currently the darling of the Dubai mid market. It crosses over 1 billion AED in sales transactions every single month. If you listen to the average "pill giver" broker, they will tell you that any studio in JVC is a gold mine. They are wrong. As a data certified consultant, I don't look at the hype; I look at the looming deadline set by the master developer, Nakheel.

The 2030 Deadline: A Flood of Concrete

There are currently approximately 38,000 ready units in JVC. However, the plan is to reach 65,000 units by the year 2030. Nakheel has issued a strict directive to developers: complete your projects by the end of 2027 or 2028. This means a massive influx of inventory is hitting the market simultaneously.

If you are an investor buying a generic unit without a "surgical" strategy, you are walking into a supply trap. When 100 investors in your building try to list their properties for rent at handover, the only thing that will save you is scarcity within the building. This is why I emphasize the 03 or 09 series. Layouts and views are the only things that cannot be replicated. While most of JVC is a concrete jungle, units facing a lagoon or one of the 39 parks will always command a premium.

The End User Shift: From Hype to Maturity

JVC is becoming a mature community. It is no longer just for "Opportunity Investors" who buy in the dirt; it is now for "Security Investors" and end users who want schools and malls ready. The community is outperforming because of its affordability and connectivity, located just 20 minutes from Downtown.

But don't be fooled. Affordability does not mean "cheap". We don't use that word in Dubai. A property is either affordable or it is a liability. In JVC, the rental yield is currently high at 6.89% to 7%, but as those 65,000 units flood in, that yield will face pressure. You must buy a unit that an end user family will actually want to live in five years from now.

Knowledge Trumps Information

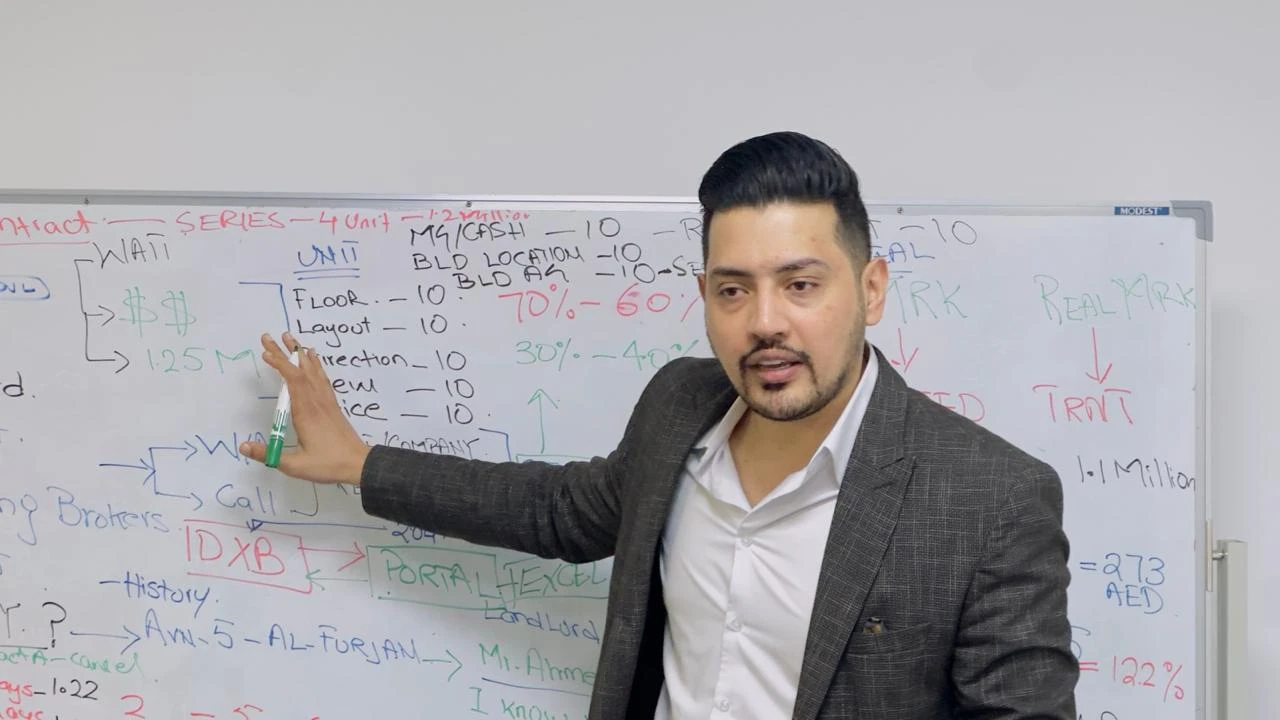

You can find the price of a JVC studio on Google. That is information. Knowledge is knowing that RTA has approved six new entrances for JVC to solve the traffic problem. Knowledge is knowing exactly where the metro station will pass by. If you aren't using a consultant who understands these infrastructure plays, you are just gambling with your capital.

The capital appreciation in JVC has been staggering, hitting 78% over the last four years. But history is not the future. I predict a 16% to 18% appreciation for the right units, while generic units will likely face a correction. My military discipline means I won't sugarcoat this: if you buy the wrong unit in JVC, you will struggle to resell it.

Don't get trapped in the 65,000 unit supply wave. If you want to secure a unit in the 03 series before the 2028 deadline, you need a surgical diagnosis. Book your exclusive JVC Strategy Session with Ali Faizan Syed today.