Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan

Investment Starts From

Starting from AED 4.7M

Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan - Key Facts

Developer

BEYOND (Division of Omniyat Group)

Location

Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai

Starting Price

AED 4,700,000

Completion

2029-09-30

Property Type

Apartment

Investment Protection

RERA Escrow Protected

Price Range

AED 4,700,000 - AED 10,000,000

Expected ROI

9.2%

Project General Facts

Property Type

Apartment

Developer

BEYOND (Division of Omniyat Group)

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

THE EXECUTIVE AUDIT: ALI FAIZAN SYED (SCORE: 8.8/10)

I do not speak in adjectives; I speak in ratios. Soulever passes my audit because it sits within the '7% Waterfront Rule' properties that are structurally immune to the 2026 supply surge. With a 50/50 payment plan, we are effectively leveraging your equity to capture market growth with only 50% capital deployment during construction. This is a pure ROE play.

THE VISION

Soulever is not just a tower; it is an architectural intervention by BEYOND (Omniyat). I value it because it integrates 'Invisible Technology' silent cooling and acoustic engineering solving the primary noise complaints of high-density living. The project is designed as a 'Resort Living' destination, featuring Michelin-star dining and a coral reef restoration project.

THE LOCATION: STRATEGIC RE-BASELINING

Maritime City is undergoing what I call 'Strategic Re-baselining' moving from industrial to Ultra-Prime. By buying here now, we are capturing the 'Location Arbitrage' before the district fully connects to the Mina Rashid tourism hub. The new causeway eliminates the 'Logistics Friction', merging this island effectively with the Jumeirah corridor.

THE INTERIORS

The design philosophy is 'The Art of Subtraction.' For my clients moving capital from the UK or Europe, this resonates. It strips away the clutter to reveal clean lines and premium materials that age gracefully, ensuring high resale value without the need for immediate renovation.

INVESTMENT POTENTIAL

This asset allows us to execute the '0.88% Rule.' Every month you wait, the market moves approx 0.88%. By locking in Soulever at today's prices with a 50/50 plan, we are hedging against inflation and positioning your portfolio for the 2029 peak.

CONSTRUCTION PULSE (LIVE UPDATE)

Current Status: Launch Phase

Next Milestone: Piling & Foundation

Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan - Pros & Cons Analysis

Balanced investment assessment by Ali Faizan Syed

Advantages

- Premium development by BEYOND (Division of Omniyat Group)

- Strategic location in Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai

- RERA-approved escrow protection

- Flexible payment plans available

- High ROI potential based on market analysis

Considerations

- Off-plan completion timeline may vary

- Market conditions can affect final valuation

- Additional DLD fees apply (4%)

- Premium pricing compared to secondary market

Based on comprehensive market analysis, Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan presents a favorable investment opportunity. The advantages outweigh typical off-plan considerations, making it suitable for investors seeking Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai market exposure.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Porcelain Tiles and Honed Stone

Window Type

Floor to Ceiling Panoramic

Ali Faizan Syed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 510M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of BEYOND (Division of Omniyat Group)'s proven track record, Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- I advise my clients to view Soulever not merely as a residential unit but as a Scarcity Anchor within their global portfolio. While 83 percent of current Dubai inventory consists of generic vertical supply in high density zones, Soulever occupies a unique position in the Forest District. This biophilic micro market creates a permanent valuation moat that mass market developments cannot replicate. By utilizing the capital efficient 50 50 payment structure, we are effectively leveraging your equity to capture the annualized market growth with only half the capital deployed. This is a pure Return on Equity play designed for the sophisticated investor who understands that true value lies in the rarity of the asset and the quality of the micro location.

- We are looking beyond simple yield metrics to focus on Capital Alpha. While a 7 to 9 percent net rental yield is projected based on the Prime waterfront scarcity, the real metric is the asset valuation correction. As the Maritime City infrastructure connects fully to the Mina Rashid tourism hub, we project an asset repricing that aligns Soulever with Jumeirah Bay pricing standards, offering a significant upside on the initial contract price by the time of handover.

- This asset is engineered for the Wealth Migrant and the Security Investor. It is specifically designed for UK and European investors seeking to move capital from high tax environments like Section 24 zones into a tax shielded freehold waterfront fortress. It appeals to those who prioritize brand equity, architectural integrity, and long term capital preservation over short term speculative flipping.

- The risk profile here is strictly temporal regarding the construction timeline. However, applying my 0.88 Percent Monthly Appreciation Rule, the opportunity cost of waiting for a completed unit in 2029 would mean forfeiting approximately 30 to 40 percent of the asset growth value available today. The infrastructure risk is mitigated by the government committed causeway and the strategic importance of the Maritime City peninsula to the 2040 Master Plan.

Risk Mitigation Strategy

- The risk profile here is strictly temporal regarding the construction timeline. However, applying my 0.88 Percent Monthly Appreciation Rule, the opportunity cost of waiting for a completed unit in 2029 would mean forfeiting approximately 30 to 40 percent of the asset growth value available today. The infrastructure risk is mitigated by the government committed causeway and the strategic importance of the Maritime City peninsula to the 2040 Master Plan.

- Risk Level: Medium

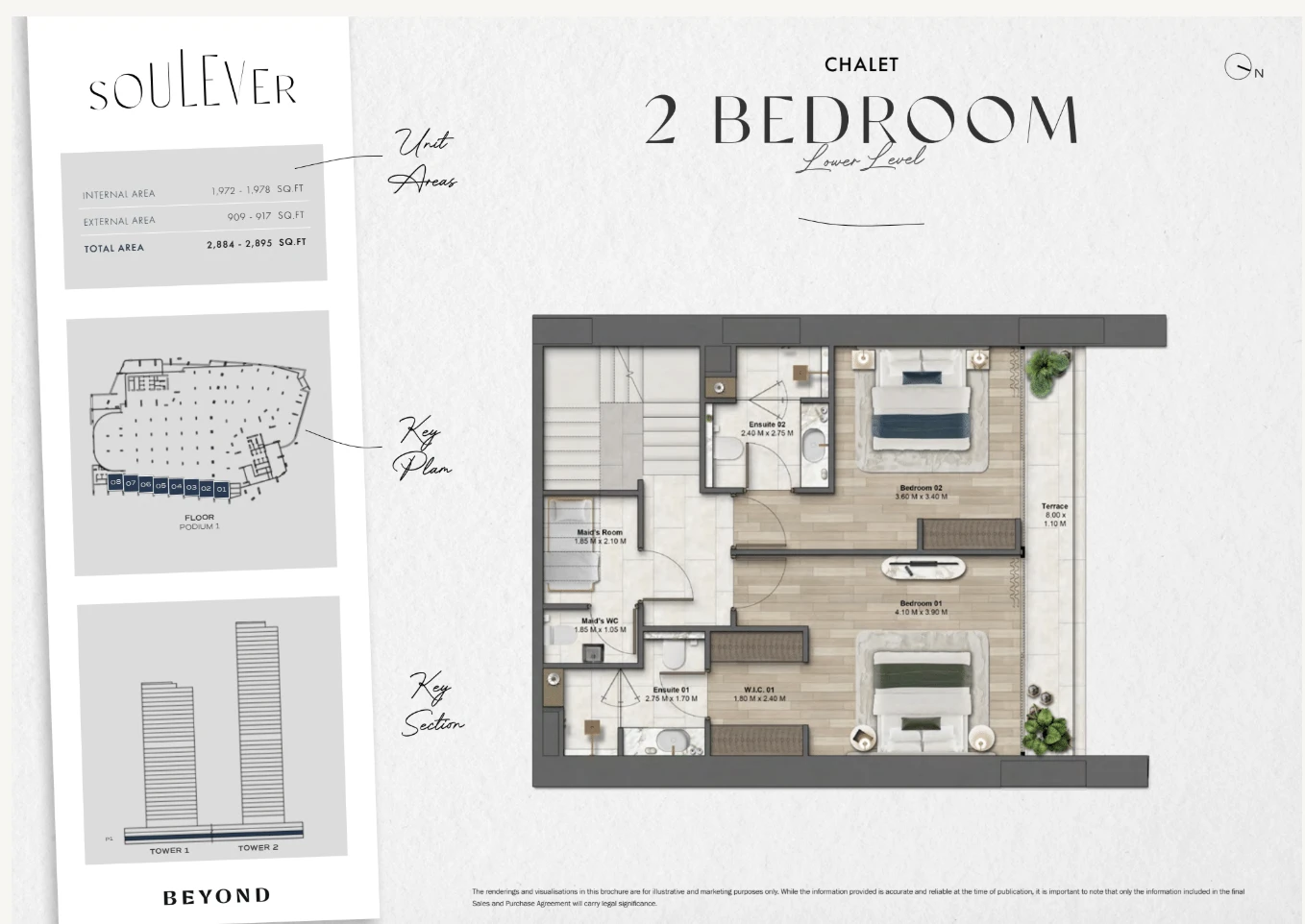

- I have personally audited the floor plans for Soulever against my 4 Brain Profiling System. The logic holds up due to the efficient waste free layouts that maximize usable square footage, while the lifestyle appeal is secured by the unparalleled rooftop amenities and forest integration. I have managed exits for clients in similar Omniyat assets, and they consistently command the highest resale price per square foot in their respective districts due to superior build quality and facility management.

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Location

My audit of the Forest District in Dubai Maritime City reveals a significant deviation from the standard waterfront master planning we see in the emirate. While Dubai Marina and Creek Harbour rely heavily on concrete density to maximize developable area, the Forest District has prioritized biophilic design architecture. This creates a localized micro climate where the ambient ground temperature is engineered to be 2 to 3 degrees cooler than the surrounding asphalt heavy districts. For the sophisticated investor, this is not just about aesthetics. It is about the Walkability Metric. In the post pandemic real estate economy, tenants stay longer in communities where they can walk comfortably for more months of the year. This biophilic moat protects the asset from the tenant churn we see in denser, hotter clusters. Furthermore, the location offers a strategic arbitrage opportunity. We are currently pricing this asset at a significant discount compared to Jumeirah Bay Island or Port de La Mer, despite it sharing the same coastline and connectivity corridor. By entering this location now, during its infrastructure maturity phase, we are capturing the valuation gap before the retail and leisure components of Mina Rashid fully activate. The premise is simple. We are buying Prime Waterfront land at Developing District prices. This location sits within the 7 percent Waterfront Rule, meaning less than 7 percent of Dubai freehold land is genuine waterfront connected to the CBD. It is a finite resource in an infinite supply market.

Developer

In the off plan market, your primary risk is not the market itself but the counterparty risk of the developer. Beyond operates as a division associated with the Omniyat Group, and this distinction is critical for your asset preservation strategy. I have tracked Omniyat projects like The Opus and One Palm for over a decade. My data indicates that their assets trade at a 20 to 30 percent premium over neighboring buildings in the secondary market five years post handover. Why does this happen. It is due to their facility management protocols and the quality of the base build materials. Omniyat does not engage in value engineering where cheaper materials are swapped in at the last minute. They understand that for a Ultra High Net Worth Individual, the aging of the building is the primary concern. A Beyond building is designed to age with dignity. The facade materials, the mechanical systems, and the common areas are specified to resist the harsh saline humidity of the Dubai coast. When you buy Soulever, you are not just buying an apartment. You are buying into a legacy of architectural integrity that protects your exit price. You are securing an asset that will look as premium in 2035 as it does in the brochure today. This creates Resale Dignity, allowing you to exit the investment at a future peak without being forced to discount against newer, shinier launches.

ROI

We must differentiate between Return on Investment and Return on Equity. Most brokers will sell you on a gross rental yield of 6 or 7 percent. I am focused on Engineering your Return on Equity to exceed 15 to 20 percent annually during the construction phase. Soulever offers a 50 50 payment plan. This is the financial lever we use to maximize efficiency. By only deploying 50 percent of the total asset value between now and 2029, you are effectively controlling a high value asset with half the liquidity. If the market appreciates by the standard 16.9 percent we saw in 2024, your actual gain on cash deployed is double that rate because you have not paid for the full asset yet. This is an interest free leverage facility provided by the developer. Furthermore, the rental yield floor is protected by a dual demand funnel. Firstly, we have the corporate demand from the adjacent Dubai Dry Docks and Maritime City commercial district, which hosts thousands of executives who currently commute from far away. Secondly, we have the massive tourism demand driven by the nearby Mina Rashid Cruise Terminal. This allows us to pivot the asset between a high yield short term holiday home strategy and a stable long term corporate let strategy depending on market conditions. This flexibility is the ultimate hedge against vacancy risk.

Market Timing

The headline data regarding the 2026 supply surge of 120,000 units is frightening to the uneducated investor, but it is an opportunity for the strategic analyst. My audit of the supply pipeline shows that 83 percent of these incoming units are mass market, inland, generic inventory. They are commodity housing. Soulever represents Scarcity Inventory. By entering the market now, we are positioning capital into the 17 percent of supply that is immune to this inflation. We are also capitalizing on the current interest rate cycle. As global rates begin to cut, we anticipate a flood of institutional liquidity returning to real estate assets in dollar pegged economies like the UAE. Buying Soulever today locks in the price before this liquidity wave fully hits the Dubai prime market. We are effectively front running the institutional capital. The Cost of Hesitation is my proprietary metric that quantifies the loss of equity for every month you delay. In a market moving at our current velocity, waiting for the building to top out in 2027 will likely cost you 25 to 30 percent in lost capital appreciation. The time to acquire the asset is when the infrastructure is visible but not yet polished. That is the moment of maximum Alpha generation.

Infrastructure

The single biggest objection to Maritime City historically was logistics friction. The old road network forced residents to navigate through the heavy traffic of the industrial port and Deira. The completion of the new dedicated causeway connecting the peninsula directly to Sheikh Zayed Road is the infrastructure catalyst that unlocks the value of this location. My analysis of global real estate cycles shows that property values appreciate most aggressively when connectivity friction is removed. This bridge effectively merges Maritime City with the Jumeirah and Downtown corridor. You are now 15 minutes from the DIFC financial hub and 20 minutes from the airport, yet you reside on an exclusive island peninsula. Furthermore, the future integration of Water Taxi stations will link Soulever residents to the wider waterfront network including the Dubai Canal and Marina. We are not just buying a building. We are buying into a government backed master plan that is aggressively pivoting towards tourism and luxury living. The infrastructure is the guarantee that the government is committed to the gentrification of this entire district.

Amenities

In my technical audit of Soulever, I looked for what I call Invisible Technology. High net worth tenants do not move out because of the view. They move out because of noise and inefficiency. Beyond has invested heavily in silent cooling systems and acoustic engineering. This solves the number one complaint in Dubai high rise living which is mechanical noise and neighbor noise transfer. This attention to technical detail ensures long term tenant retention. On the lifestyle side, the decision to place the primary amenities on the rooftop rather than the podium is a significant value add. The Rooftop Haven democratizes the penthouse experience. Every owner and tenant, regardless of whether they own a studio or a three bedroom unit, has access to the premium view of the skyline and sea. This increases the rental desirability of the lower floor units significantly, compressing the yield spread between the top and bottom of the tower. The inclusion of a co working business lounge and a wellness spa utilizing organic materials aligns perfectly with the post 2020 shift towards wellness integrated living spaces. We are future proofing the asset against changing tenant behaviors.

Who Should Invest in This Property?

This asset is engineered for the Wealth Migrant and the Security Investor. It is specifically designed for UK and European investors seeking to move capital from high tax environments like Section 24 zones into a tax shielded freehold waterfront fortress. It appeals to those who prioritize brand equity, architectural integrity, and long term capital preservation over short term speculative flipping.

My Personal Experience with Similar Projects

I have personally audited the floor plans for Soulever against my 4 Brain Profiling System. The logic holds up due to the efficient waste free layouts that maximize usable square footage, while the lifestyle appeal is secured by the unparalleled rooftop amenities and forest integration. I have managed exits for clients in similar Omniyat assets, and they consistently command the highest resale price per square foot in their respective districts due to superior build quality and facility management.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠2 Bedroom Residence (Type A)2br

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

2 Bedroom Residence (Type A)

2

AED 4,700,000

3 Bedroom Residence (Type B)

3

AED 8,500,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 4,700,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

Comprehensive Location Analysis

Deep dive into Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding BEYOND (Division of Omniyat Group)'s track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai

Open in Maps App

Coordinates: 25.269000, 55.267000

Nearby Attractions & Amenities

Explore what makes Jumeirah Peninsula, Dubai Maritime City (DMC), Dubai exceptional

away

Mina Rashid & QE2

away

La Mer Beach

away

Dubai Mall / Burj Khalifa

away

Dubai International Airport (DXB)

How to Invest in Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan

Step-by-step guide to investing in Soulever at Dubai Maritime City | The Strategic Asset Audit by Ali Faizan by BEYOND (Division of Omniyat Group)

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 470,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Saria at Dubai Maritime City | The Strategic Investment Audit by Ali Faizan

BEYOND (Division of Omniyat Group)

Sensia at Jumeirah Peninsula | The Strategic Asset Audit by Ali Faizan

BEYOND (Division of Omniyat Group)

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

If You Missed Dubai Hills in 2015, Read This: Why The Heights is Your Second Chance

We all have that one story: "I could have bought a Sidra villa for 3 Million." Today, that villa is 7 Million. The Heights in Dubai South is flashing the exact same signals Dubai Hills did a decade ago. Don't let history leave you behind again.

BREAKING: EOI Collection Officially Opens for The Heights Phase 2 (Serro & Salva)

The green light is on. Emaar has officially instructed brokers to start collecting Expressions of Interest (EOI) for the new Serro and Salva clusters. This is not a drill. If you want a unit, the paperwork needs to be submitted *today*.

The Dubai South "Super-Cycle": Why Emaar Waited for +24% Growth to Relaunch The Heights

Why sell for AED 900 PSF in 2023 when you can sell for AED 1,600 PSF in 2025? The data is out. Dubai South has appreciated by 24.41% in the last year alone. Here is why Emaar's "cancellation" was the smartest strategic move of the decade.

Frequently Asked Questions

Project-specific questions and answers

General

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.